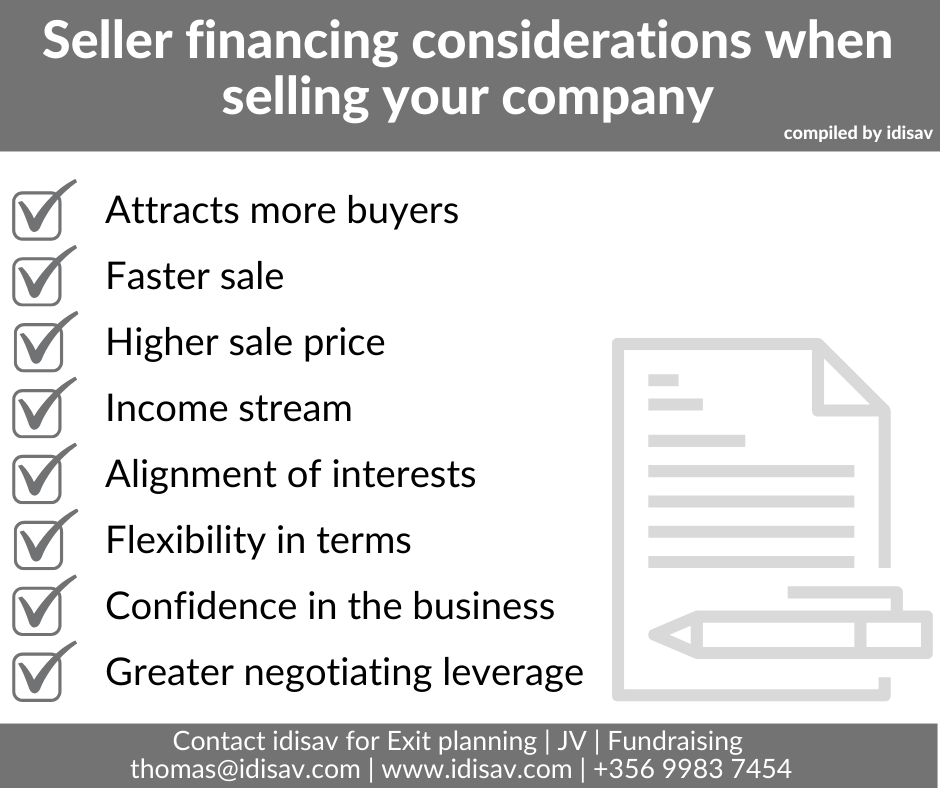

🌟 Selling your company? Consider Seller Financing for a smoother journey! 🚀 Here’s why:

- 💰 Attracts More Buyers: Expand your pool of potential buyers.

- ⏩ Faster Sale: Accelerate the selling process.

- 📈 Higher Sale Price: Maximize your return on investment.

- 📊 Income Stream: Secure a steady flow of income post-sale.

- 🤝 Alignment of Interests: Ensure shared success with the buyer.

- 🔄 Flexibility in Terms: Tailor the deal to your unique needs.

- 💼 Confidence in the Business: Demonstrate your belief in the business’s future.

- 💪 Greater Negotiating Leverage: Strengthen your position at the negotiating table.

Ready to explore these benefits? Contact us on thomas@idisav.com or +356 9983 7454 for guidance on your acquisition or exit strategy. 📧

Let’s make your business transition a success! 💡✨ #ExitPlanning #BusinessAcquisition #DealStructures #Strategy #BusinessBroker #Entrepreneurship #ExitStrategy #Merger #Acquisition #Consultancy #Accountants #DueDiligence #BusinessStrategy