When a business owner contemplates selling their successful company, strategic planning becomes paramount. Whether such sale is a management buyout, a divestment of their shareholding, or another exit strategy, a well-thought-out plan enhances the prospects of optimal terms and pricing.

In ideal circumstances, the business will be positioned so that the widest pool of buyers will be attracted to acquire it. This is undertaken by preparing the business and presenting it to prospective acquirers with a minimal number of “issues”.

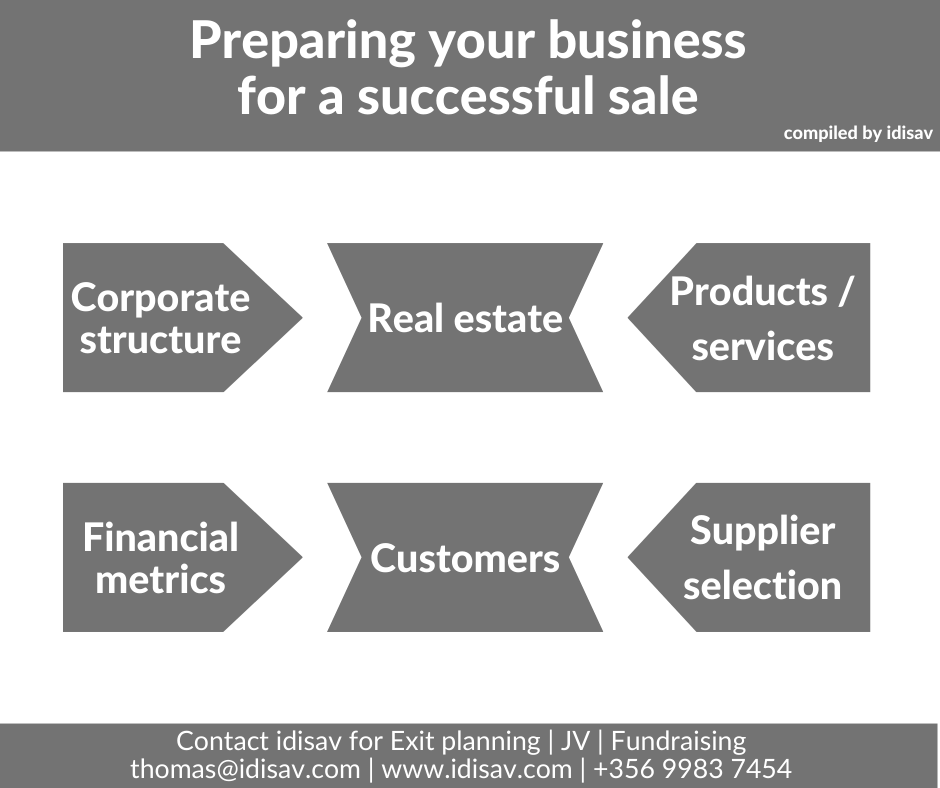

Here are some key considerations to ensure a smooth transition:

- Corporate structure

A prospective acquirer will be keen to assess the business’ dependency on the owner and thus the corporate structure will be of key interest. Should there be an excess of such a dependency, a seller should consider strengthening their executive team. A significant dependency on one individual may result in a potential acquirer losing interest in the business, or possibly an extensive and time-consuming handover clause in the eventual sale agreement.

In addition, one must assess whether the owner(s) and employed family members are being paid a fair wage, as it is often seen that sole business owners fall within two extremes – either paying themselves a minimal salary or an overly inflated salary, either of which will not meet market expectations and will create a discrepancy in the company’s results.

- Real estate

Numerous businesses in Malta own the real estate from where they operate. It is often recommended to create a separate company to own the real estate which is distinct from the operational business. The real estate company will then charge a market rate rent to the operational company. In doing so, should the business owners wish to retain the real estate but sell the operational business, this segregation would facilitate this strategy.

- Products and/or services

The business owner(s) should assess the types of products and services that are being provided, and whether the margin is in line with industry expectations.

Furthermore, one should continue enhancing the product offering by increasing possible ‘barriers’ to entry for new participants and to develop a ‘moat’ around the products from possible competition.

Should the company provide a service offering, the business owner(s) should assess means to make it more process-based, that is to have a process set out and documented (with the relevant costings) in order to facilitate the smooth takeover process with the proposed buyer.

- Controlling stock and other key financial metrics

Throughout the any business period, and particularly during the period leading to the exit, the business owner(s) would closely manage the company including the amount of stock being held, as well as any creditors and debtors of the company.

One should bear in mind that no prospective buyer is going to pay for stock that has not been properly managed. If not yet implemented, the company should invest in stock management system to ensure that the company’s stock levels are being managed efficiently.

Furthermore, throughout the acquisition process, the acquirer should be able to ascertain that the company maintains optimal working capital levels, and how that is financed through the presentation of updated management accounts.

- Customers

The business owner(s) should assess if there is an excessive dependency on key customers, and if there are risks of these customers ceasing to purchase from the company. Such a dependency may have a direct impact on the price and terms of the agreement, since the relative transfer agreements are occasionally conditional on a minimum number of customers being retained post-acquisition.

In addition, an analysis of the company’s customers should be undertaken see which ones are truly beneficial to the business and which ones are depressing margins.

- Supplier selection

Certain businesses may be overly dependent on select suppliers, and this may place the business at risk if, for example, the supplier had to terminate its product line or, possibly, the supplier themselves being acquired and resulting in a change in their product/delivery priorities.

One could consider the insertion of a clause in the transfer agreement noting how that agreement would be affected should any defined supplier relationship/s not continue on similar terms with the business post-transaction.

Conclusion

While this article provides a high-level overview of the exit strategy, each business is unique and requires a case-by-case analysis. Consultation with experts throughout the process is highly recommended to ensure the best results for this significant milestone in a company’s journey.