The implementation of Transparency Reports instils stakeholders with increased confidence in the accounting profession on the basis of the accountants’ and auditors’ declarations. Such reports empower readers to make informed decisions, assured that their interests are safeguarded, and that auditors maintain independence, avoiding undue influence from any specific client’s financial significance.

What is a transparency report?

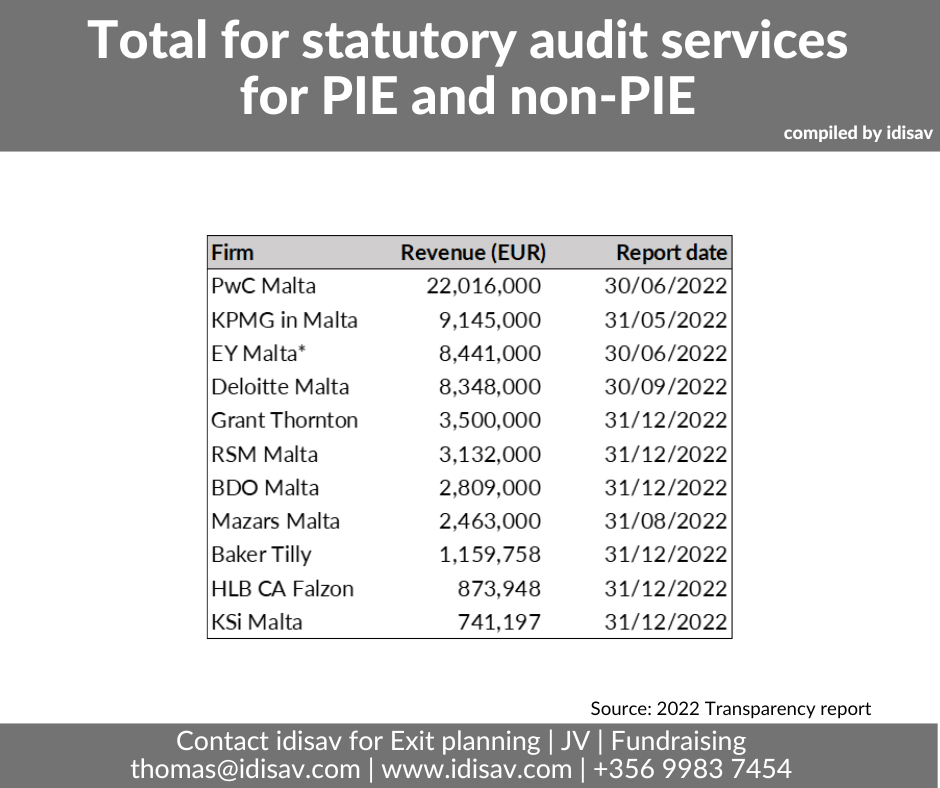

Any auditor, or any audit firm, that carries out statutory audits of public-interest entities is required to adhere to legislative requirements and publish an annual transparency report.

Article 2 of the Accountancy Profession Act defines a ‘public-interest entity’ (PIE) as an entity whose transferable securities are admitted to trading on a regulated market of any Member State.

Audit and non-audit services

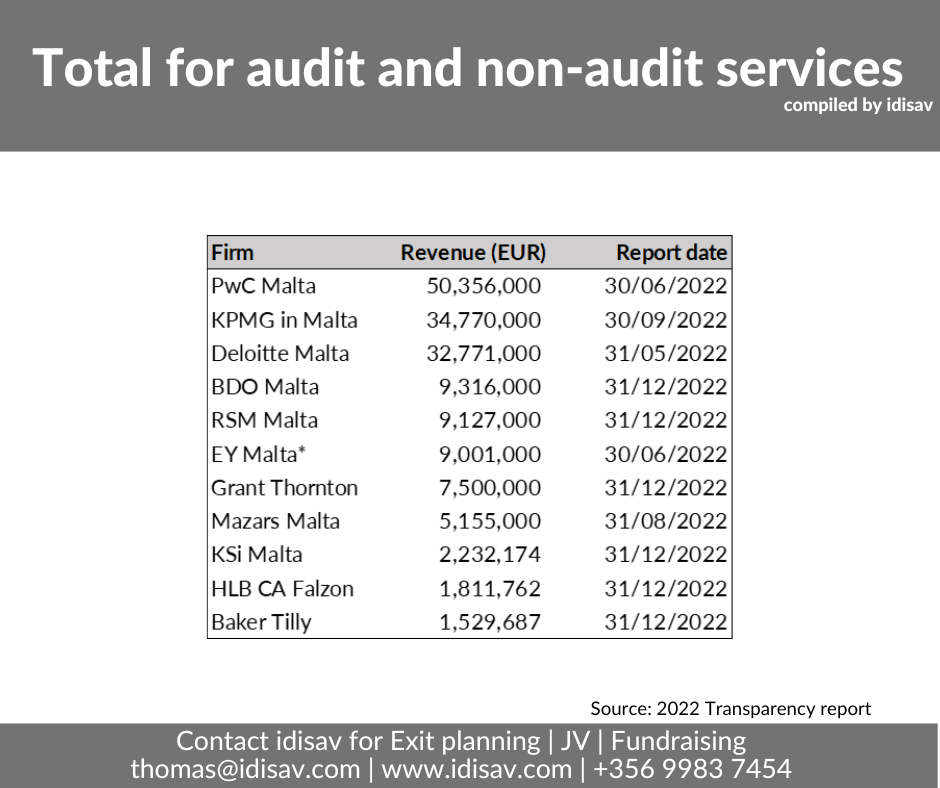

For the purpose of this article, 11 firms have been selected and these show a combined revenue of over €160 million based on the 2022 Transparency Reports.

The total revenue for audit and non-audit services category clearly demonstrates that PwC Malta is ahead of other firms in their revenue performance. The second and third places are only separated by two million Euro in revenue, with a negligible difference for fourth position between BDO Malta and RSM Malta.

Interpreting the Transparency Report financials

While the Transparency Reports provide insight into the firms’ operations, they may not fully capture the complete scope.

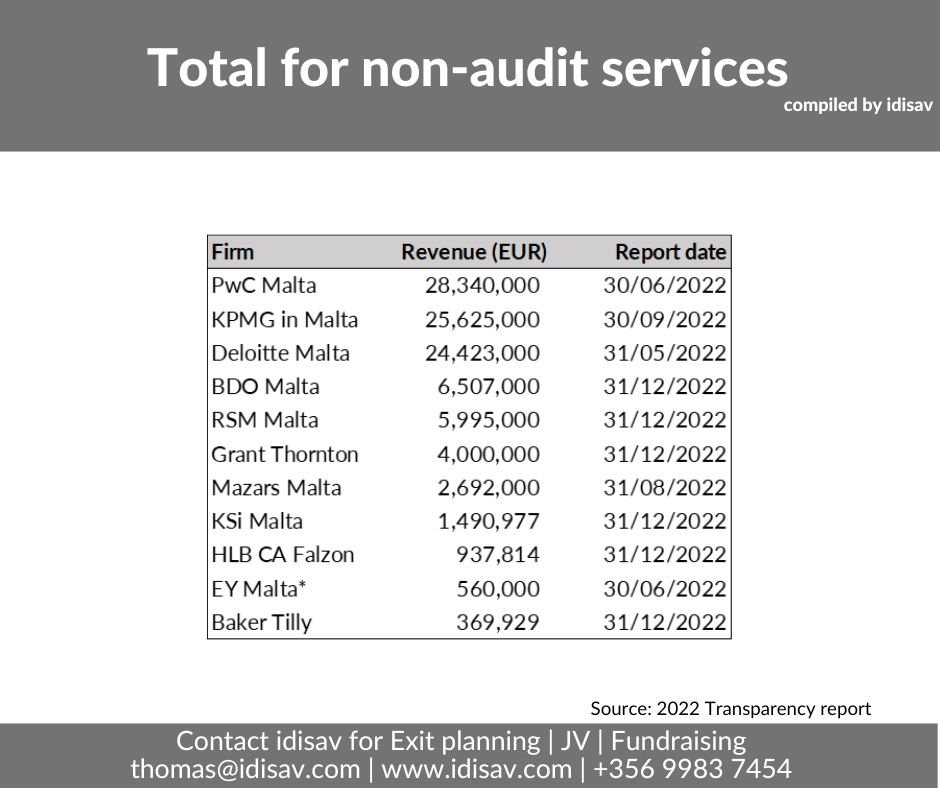

For instance, EY Malta is commonly recognized as one of the ‘Big Four’ firms in Malta. However, in the ‘Total for audit and non-audit services’ rankings, it appears in sixth place. Additionally, it’s worth noting that the firm’s Transparency Report financial information specifically pertains to the Assurance entity and does not encompass revenues from other EY Malta entities, such as Ernst & Young Limited, where an additional €12 million in revenue is disclosed (source: 30 June 2022 financial statements).

Other observations

Moreover, it is noteworthy to mention that Equis, PKF Malta and TACS Malta have also issued Transparency Reports, albeit for the purposes of this article they were deliberately omitted from the dataset under consideration. This decision stemmed from specific observations: PKF Malta did not furnish an overview of its financial outcomes, while Equis and TACS Malta presented their financial results in a format inconsistent with that of their counterparts.

Conclusion

The ‘mid-tier’ level of firms could be considering further consolidation in a bid to address the ever-increasing burden in compliance costs and other regulatory commitments. In the recent past, there have been a number of acquisitions, in particular, by the ‘Big Four’ firms. It would be interesting to observe how any such future consolidation/s will affect the Transparency Report and those firms’ overall ranking.

idisav

idisav was founded by Thomas Cremona, through which they assist entities with exit planning, fundraising, and joint ventures.