💼 Equity is the heart of a company’s balance sheet—what’s left for the owners when you subtract liabilities from assets! #BusinessFinance #Equity #BalanceSheetBasics

Author Archives: Thomas Cremona

Happy New Year!!

Why Every Business Owner Should Think About Exit Planning

Exit planning is a topic that many business owners in Malta overlook, often because they associate it solely with, succession planning, retirement, or selling their company. However, a solid exit plan is not just about stepping away—it’s about securing your business’ future, maximising its value, and ensuring a smooth transition when the time comes. WhyContinue reading “Why Every Business Owner Should Think About Exit Planning”

Contract terms vs Valuation

While a company’s valuation often grabs the headlines, many business owners overlook the importance of contract terms—arguably just as crucial, if not more so. It’s essential to pay close attention to earn-out clauses, the potential loss of transferred clients, and other factors typically included in a business transfer agreement.

Revenue multiple valuation

Valuing a company through a revenue multiple is rarely used, though you will come across it, and from experience it has primarily arisen in accountancy practices. I always find that a curiosity that whilst accountants created a number of valuation methodologies for various industries they often utilise a revenue multiple when valuing their own firms.Continue reading “Revenue multiple valuation”

Fair value

When discussing valuations you will routinely come across the term “fair value” which is defined as…

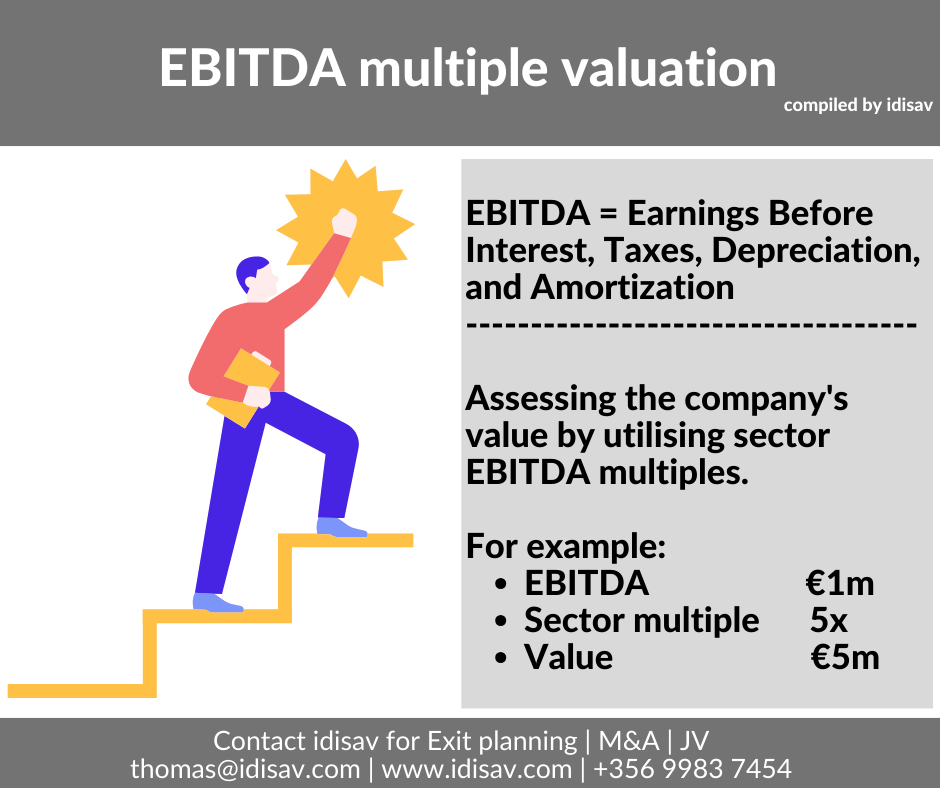

EBITDA multiple valuation

A valuation method you will often come across is the EBITDA multiple valuation. It is often used as a benchmark number, though be wary of using it, as no two companies are the same, and thus one needs to take a more in-depth look into the business to reach a more precise valuation.

Owner’s remuneration

In many businesses, the owner-manager is often either underpaid or overpaid, so adjustments to EBITDA may be necessary to reflect the business’ true earning potential.

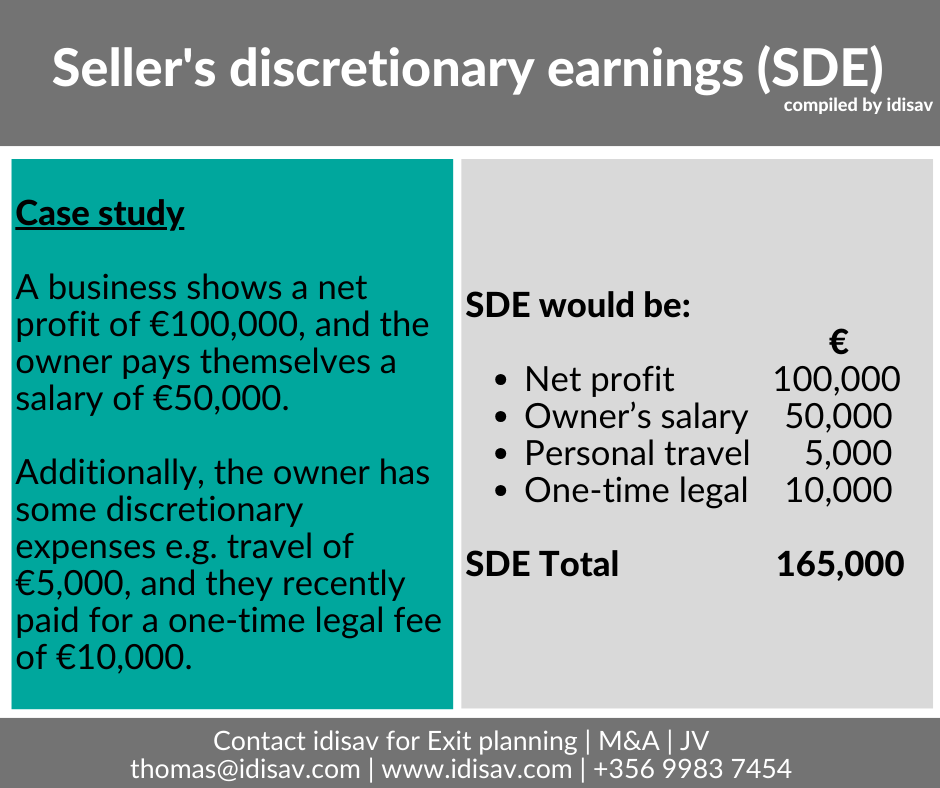

Seller’s discretionary earnings (SDE)

A valuation may reference the ‘Seller’s Discretionary Earnings (SDE),’ which is often utilised in small to mid-market company valuations where the owner’s income and personal expenses may materially affect the financial results.🛩 🥐 ⛵

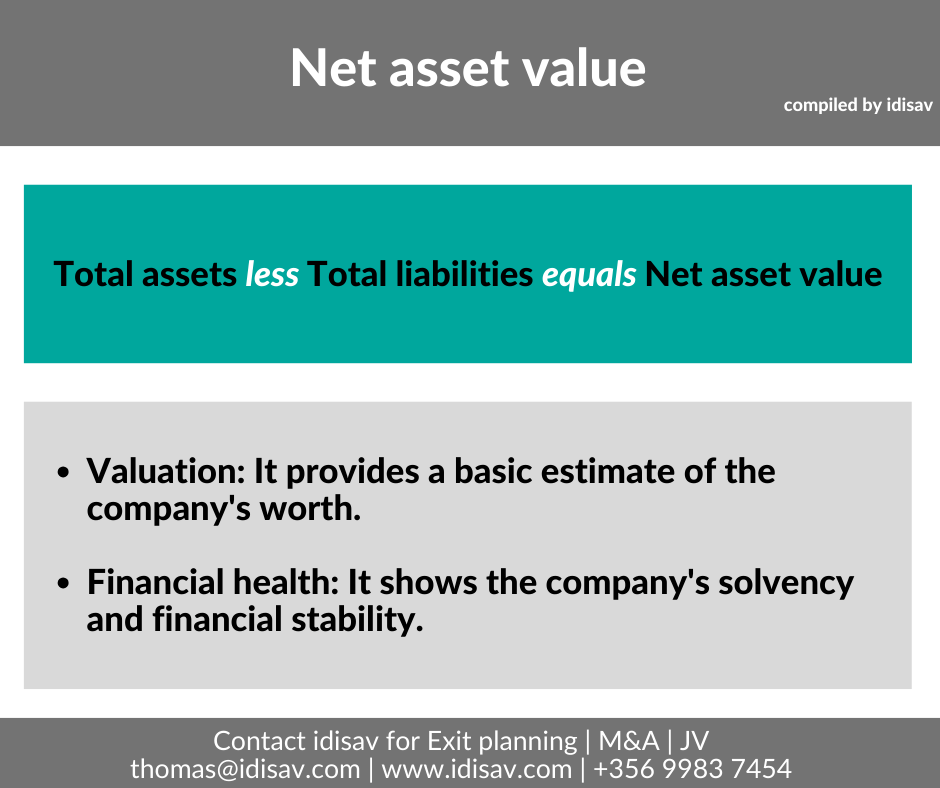

Net asset value

Ever wondered where to start from when analysing a company’s value, check its Net Asset Value, and continue working from there 🎯