1️⃣ Long-Term Decisions2️⃣ Smooth Transition3️⃣ Advisory Team4️⃣ Post-Exit Plans 📞 Contact idisav for tailored exit strategy assistance. Let’s shape your business legacy! Check out your exit team members with this infographic -> https://lnkd.in/dUd6fqUf

Author Archives: Thomas Cremona

Ready to exit?! Preparing your business exit strategy

📈 Ready to Exit? Prep Your Business for Success! Ensure a smooth transition with these key preparations: 1️⃣ Limit Dependence on the Owner: Cultivate a team and processes that operate independently. 2️⃣ Proprietary Products and Services: Showcase what sets your offerings apart in the market. 3️⃣ Strong Management: A capable leadership team ensures continuity post-exit.Continue reading “Ready to exit?! Preparing your business exit strategy”

Negotiating an acquisition

📈 Exploring a Business Acquisition? Consider These Negotiation Tips! 🤝 In the journey to acquire a business, effective negotiation is key. Here’s what the process might entail: 💰 Price and Payment Terms: A deal that aligns with your budget and financial strategy.📦 Assets and Inventory: Ensure a comprehensive understanding of what you’re acquiring.⚖️ Debts &Continue reading “Negotiating an acquisition”

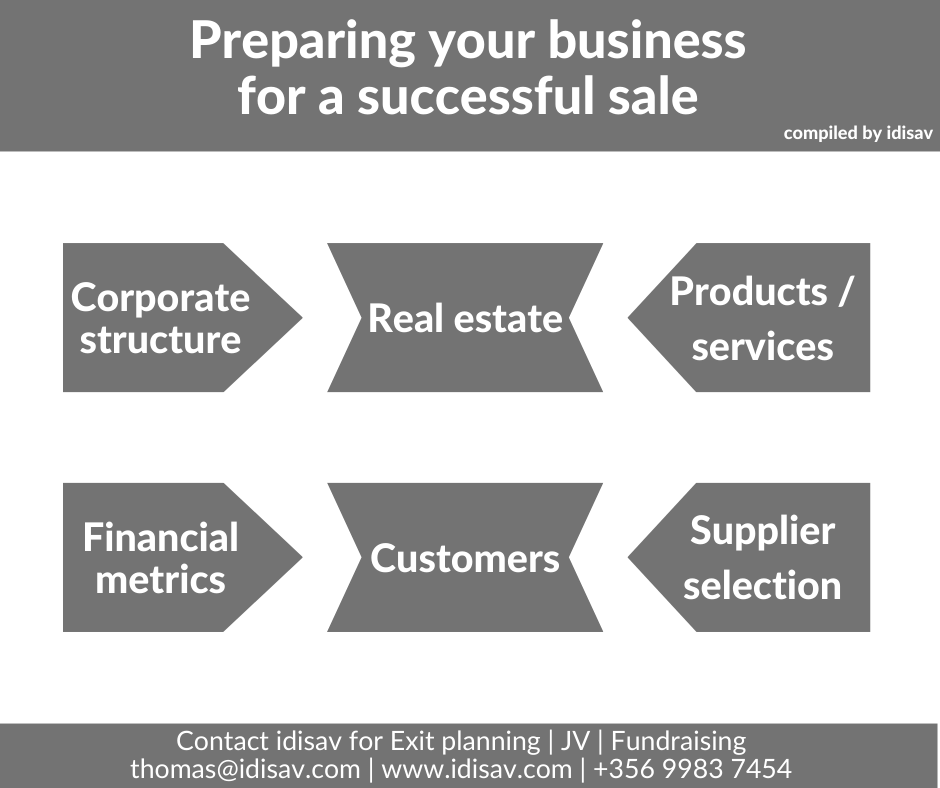

Preparing your business for a successful sale: Key strategies for business owners

When a business owner contemplates selling their successful company, strategic planning becomes paramount. Whether such sale is a management buyout, a divestment of their shareholding, or another exit strategy, a well-thought-out plan enhances the prospects of optimal terms and pricing. In ideal circumstances, the business will be positioned so that the widest pool of buyersContinue reading “Preparing your business for a successful sale: Key strategies for business owners”

Who may be interested in acquiring your business?

🔍 Exploring Potential Acquirers? Consider These Options! 🤝 👋 Wondering who might be eyeing your business for acquisition? Here are some possibilities to ponder: 1️⃣ Competitor: Your industry counterpart might see value in what you’ve built.2️⃣ Existing Partner: Strengthen existing collaborations by becoming part of their journey.3️⃣ Family Member: Passing the torch to a familyContinue reading “Who may be interested in acquiring your business?”

Thank you to Malta Business Weekly for publishing our article on “Reasons for selling your business”

Maximising your business’ potential with an exit strategy

🚀 Elevate Your Exit Strategy with idisav! 🌐 ✅ Make Long-Term Decisions ✅ Ensure a Smooth Transition ✅ Maximise Your Business Value ✅ Secure Recurring Income Post-Exit 📞 Contact idisav for personalized assistance. Let’s shape the future of your business! Check out this infographic – https://idisav.com/2023/05/30/exit-planning-position-the-company-to-achieve-its-greatest-value-%f0%9f%8f%86%f0%9f%92%aa%f0%9f%98%83/

🚀 Is Your Company Ready for Acquisition?

Let’s Break it Down with idisav! 💼 Here’s why a potential acquirer might be eyeing your business:1️⃣ Strong Sales, Steady Cash2️⃣ Efficient Processes3️⃣ Risk Aversion4️⃣ Seller Financing5️⃣ Instant Benefits 🚀 Ready to navigate the acquisition journey? Reach out to us https://idisav.com/contact/ for expert exit strategy advice. 📞 Let’s secure your business legacy! Further information on:Continue reading “🚀 Is Your Company Ready for Acquisition?”

🔍 Considering Your Business Exit Strategy?

👋 Planning your business exit? It’s a big move, and at idisav, we’re here to break down the key options for you.1️⃣ Sell Your Business: Learn how to get your business sale-ready, attracting potential buyers.2️⃣ Merger: Explore the benefits and challenges of merging with another company strategically.3️⃣ Public listing: Taking your business public.4️⃣ Management Buyout:Continue reading “🔍 Considering Your Business Exit Strategy?”

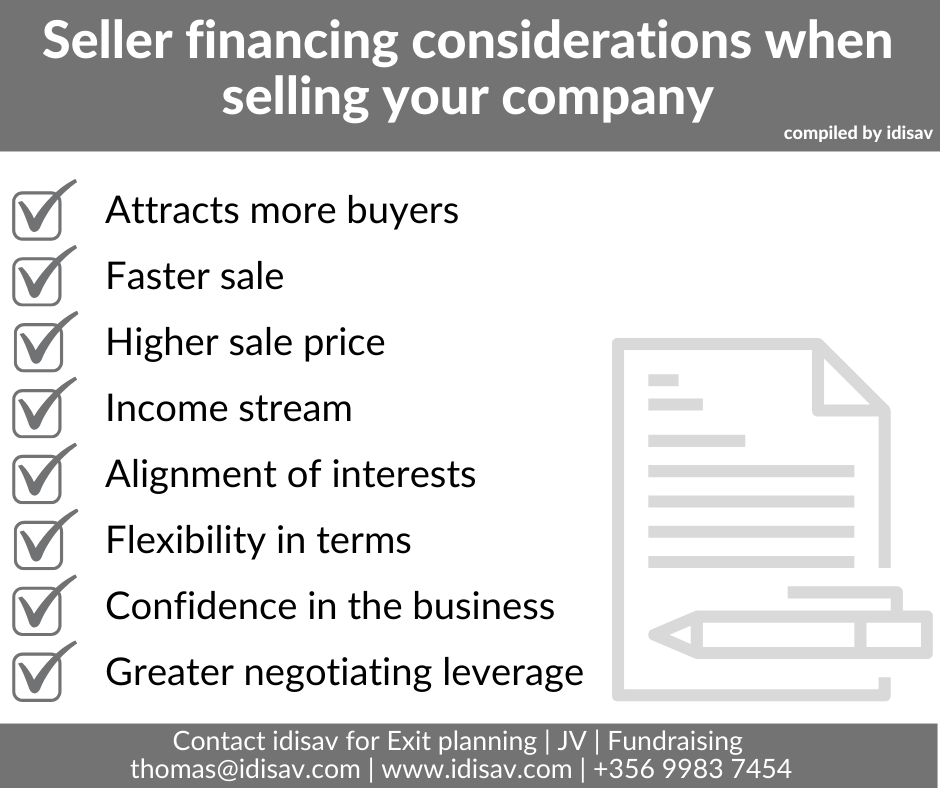

Seller financing considerations when selling your company

🌟 Selling your company? Consider Seller Financing for a smoother journey! 🚀 Here’s why: Ready to explore these benefits? Contact us on thomas@idisav.com or +356 9983 7454 for guidance on your acquisition or exit strategy. 📧 Let’s make your business transition a success! 💡✨ #ExitPlanning #BusinessAcquisition #DealStructures #Strategy #BusinessBroker #Entrepreneurship #ExitStrategy #Merger #Acquisition #Consultancy #AccountantsContinue reading “Seller financing considerations when selling your company”