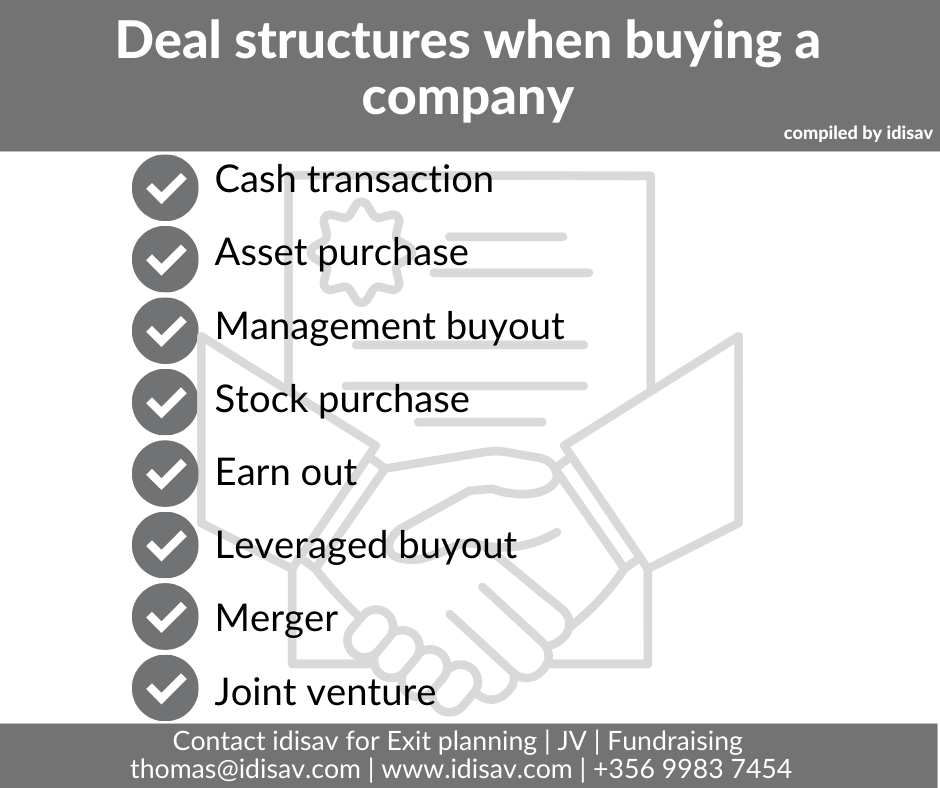

🚀 Exploring company acquisition? Discover diverse deal structures to shape your business future! 💼 Here are some options: Ready to explore these options? Contact idisav on thomas@idisav.com or +356 9983 7454 for expert guidance on your acquisition or exit strategy. 📧 Let’s shape your success story! 💡✨

Author Archives: Thomas Cremona

Structuring a deal when business partners split

Business partnerships usually get off the ground with great enthusiasm and fanfare, but the separation of such a partnership can be a source of tension, fraught with difficulty, and time-consuming. This separation process may lead to a series of stop-start negotiations and other frustrations. In the scenario where the parties have already agreed on aContinue reading “Structuring a deal when business partners split”

Wishing you a Happy New Year :)

Exploring the M&A landscape: Which is the most acquisitive accountancy firm?

Throughout the years, local accountancy practices have had to adapt to a host of challenges from increased specialisation and limited human resources to stringent regulatory requirements. This has led to a preference for firms to consider mergers or acquisitions for their established practices. The recent mergers and acquisitions in the accountancy sector have centred onContinue reading “Exploring the M&A landscape: Which is the most acquisitive accountancy firm?”

Wishing you a Merry Xmas :)

Navigating Employee Buyouts: Challenges and Strategies

When I had considered selling my first business, I had quietly broached the idea with my key employees if they would consider taking on an ownership stake in the business. For one reason or another they had individually indicated to me that there was not a firm interest in taking on a shareholding and theContinue reading “Navigating Employee Buyouts: Challenges and Strategies”

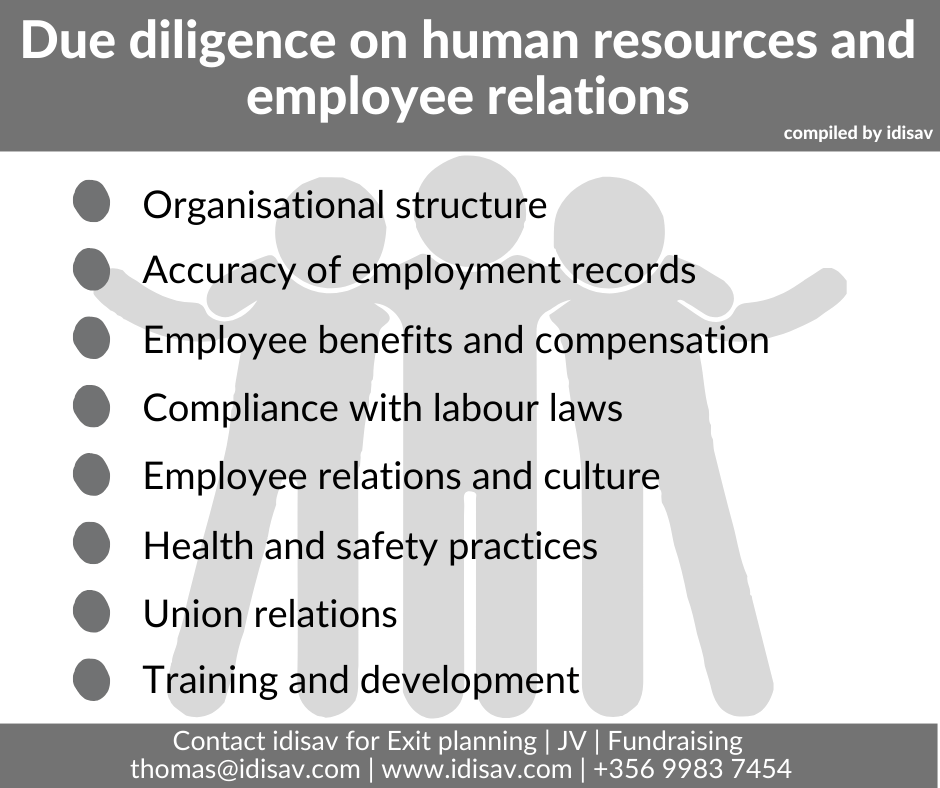

Due diligence on human resources and employees relations

📌 Considering an acquisition or exit strategy? Don’t overlook the importance of due diligence on human resources and employee relations! 🔍 Here are key factors to consider: 🏢 Organisational Structure: Understand the foundation for effective operations. 📊 Accuracy of Employment Records: Ensure a smooth transition with precise information. 💰 Employee Benefits and Compensation: Evaluate theContinue reading “Due diligence on human resources and employees relations”

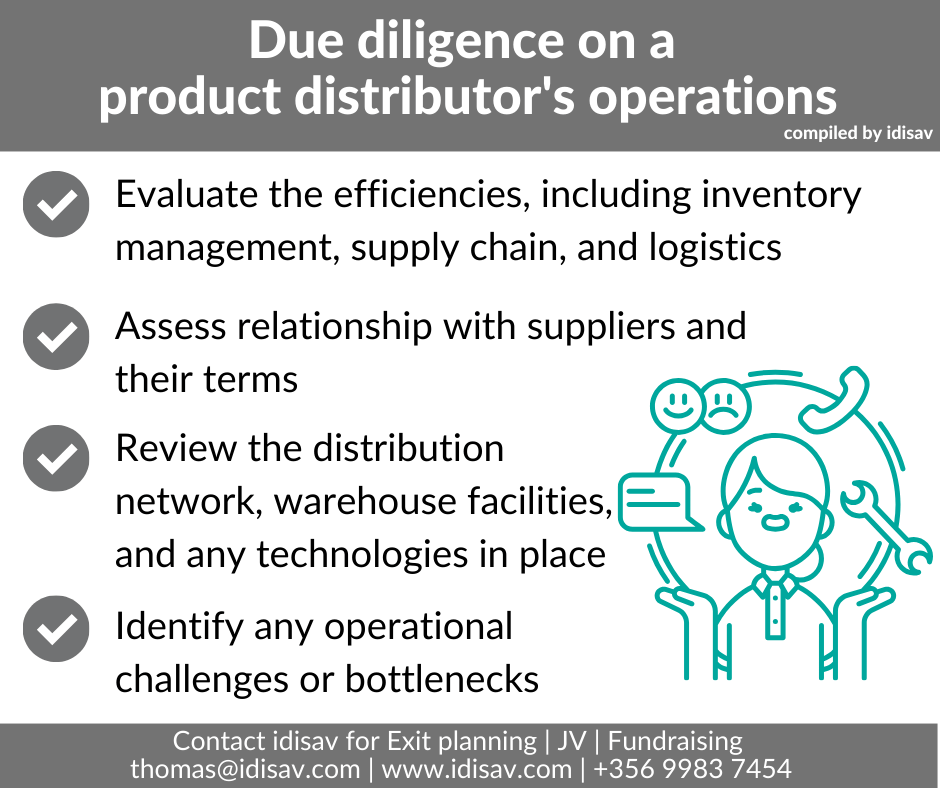

Due diligence on a product distributor’s operations

🤔 Considering an acquisition in the FMCG industry or exploring new product distribution opportunities? Here are key due diligence steps to guide your decision-making: 🔍 Evaluate operational efficiencies, including inventory management, supply chain, and logistics. 💼 Assess relationships with suppliers and scrutinize their terms for a seamless collaboration. 🌐 Review the distribution network, warehouse facilities,Continue reading “Due diligence on a product distributor’s operations”

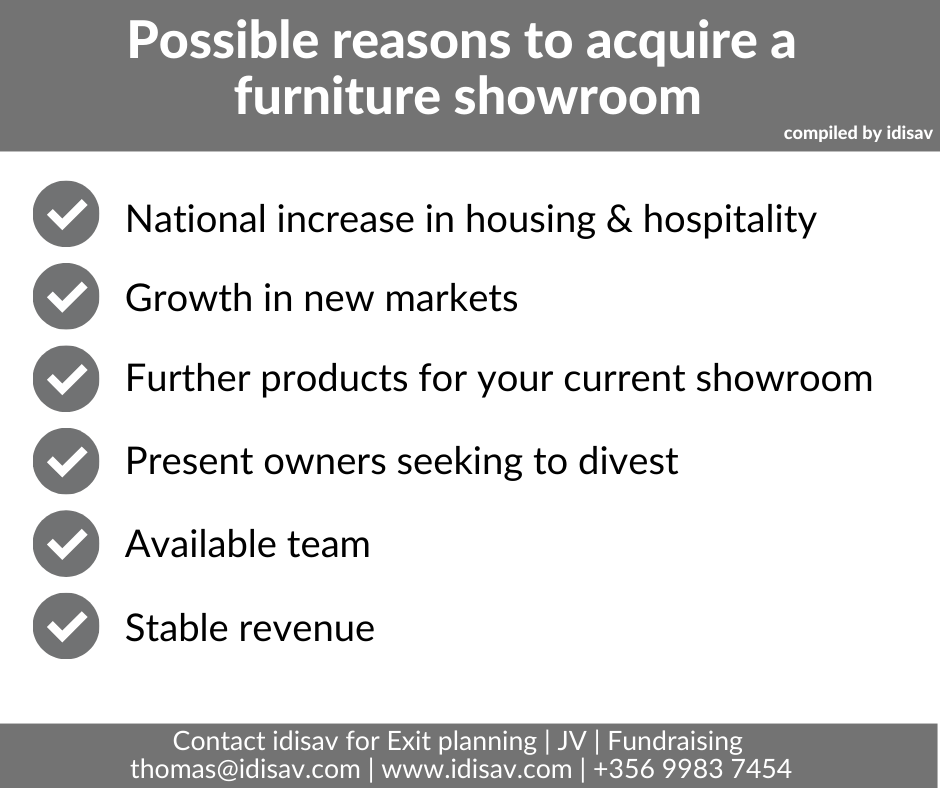

Possible reasons to acquire a furniture showroom

Whilst there may be varied reasons to acquire a business, one particular sector that may be of interest could be a #furniture #showroom and this may be due to: 🏡Increase in housing stock 🌍Seeking to expand into a new market 💼Stable revenues of a mature business 🔄Synergies with a related showroom you currently own 🌟CurrentContinue reading “Possible reasons to acquire a furniture showroom”

Legal documentation considerations when acquiring a business

Considering an acquisition or exit strategy? 🤔 Here are key legal documentation considerations you shouldn’t overlook: Navigating these legal aspects can be complex, but fear not! 💼 Contact http://www.idisav.com to get expert assistance for your acquisition or exit strategy. 📧 Their team is ready to guide you through the process and ensure a smooth transition.Continue reading “Legal documentation considerations when acquiring a business”