Operating a small business often feels like juggling a thousand different tasks, with you—the owner—right in the centre of it all. For many business owners, the idea of reducing the business’ dependency on them can seem daunting, especially when there are multiple barriers to delegation and growth. However, without taking steps to decentralise your role,Continue reading “Developing a self-sustainable business”

Category Archives: Uncategorized

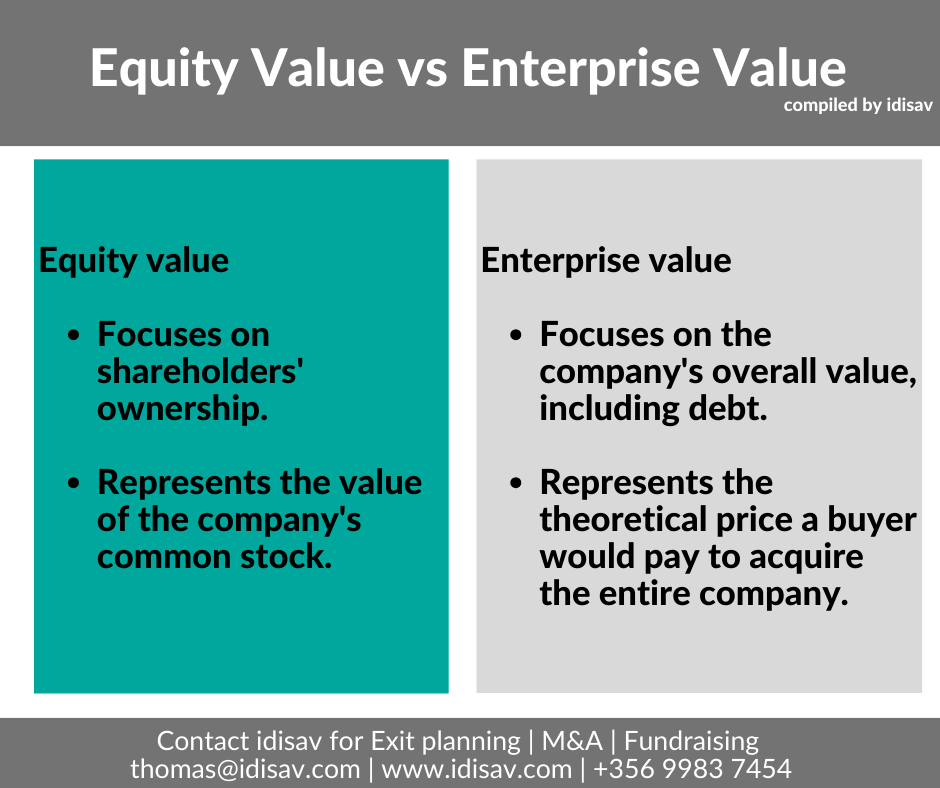

“Enterprise value” or “Equity value”?

Am I the only one who has ever been confused by seeing the letter “EV” on a valuation document, is it “Enterprise value” or “Equity value”? 🤷♂️ 🤷♀️

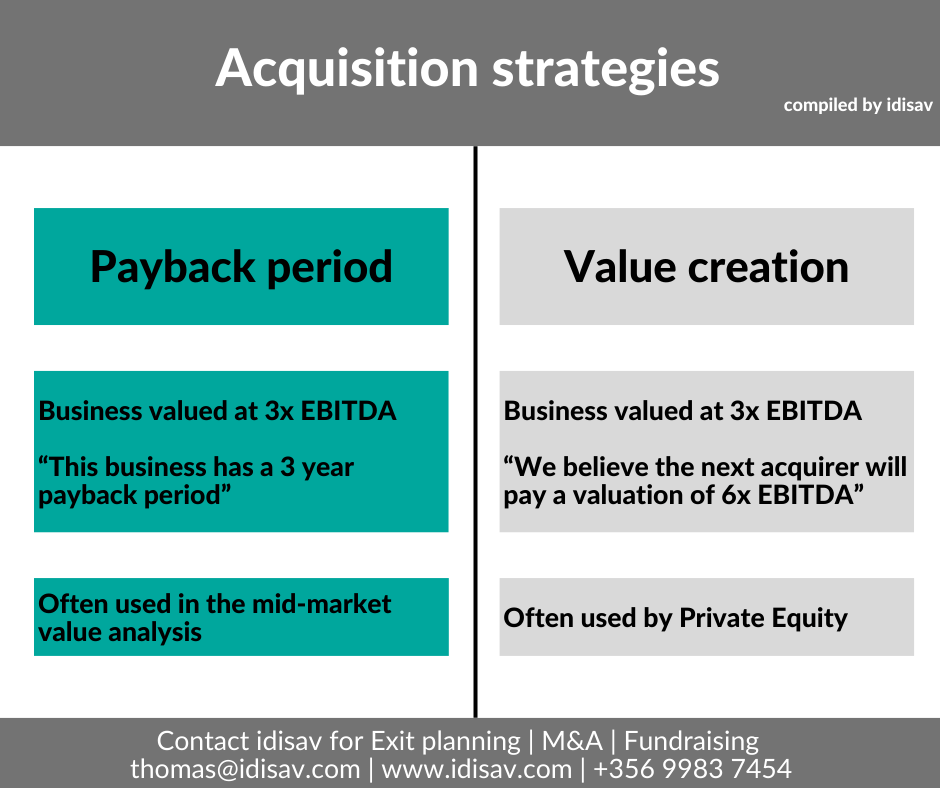

Acquisition strategies

Company valuations can vary, though a constant theme is the way a number of prospective acquirers internally process the information. Two main approaches often stand out: One group sees the company as something that will pay itself off over time. The other looks ahead, focusing on what the next buyer might pay for it afterContinue reading “Acquisition strategies”

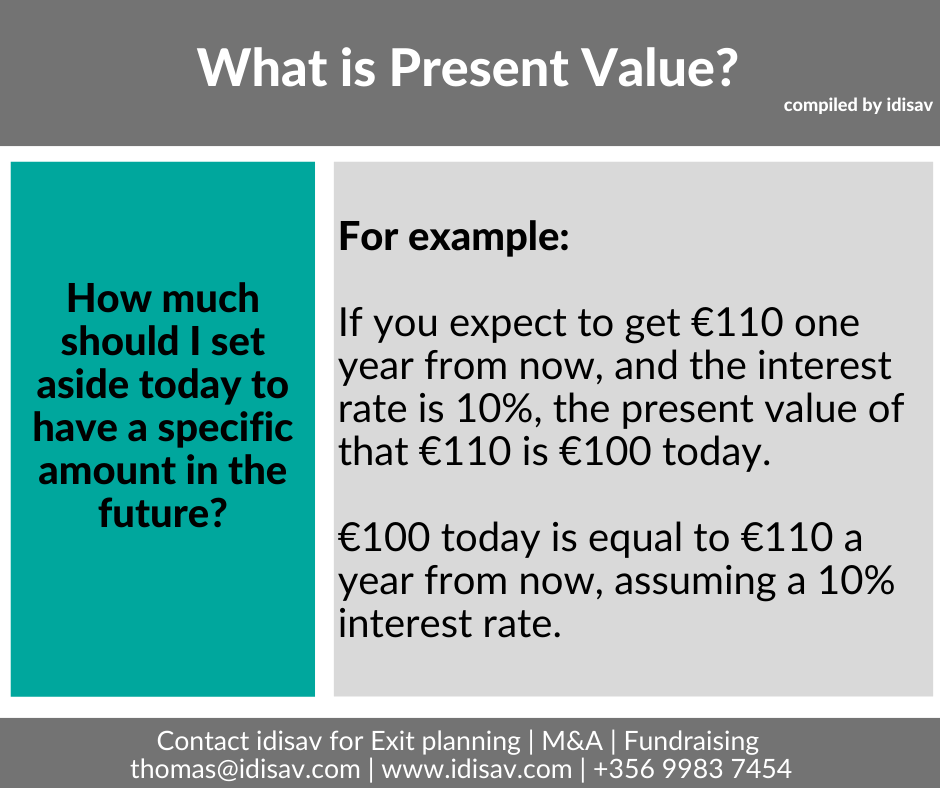

Present value

As part of the business valuation process, you will come across the term, “Present Value”. Present Value (PV) helps determine the worth of future cash flows in today’s terms. By discounting future earnings to their present value, owners and investors can make better decisions based on the true value of future profits. This approach ensuresContinue reading “Present value”

Cash Flow Due Diligence

When I began my accounting career, our Finance Director would often emphasise that ‘cash is king’—a lesson that has stayed with me. In any acquisition, cash flow analysis is a critical part of due diligence, ensuring you can meet obligations promptly and sustain growth.

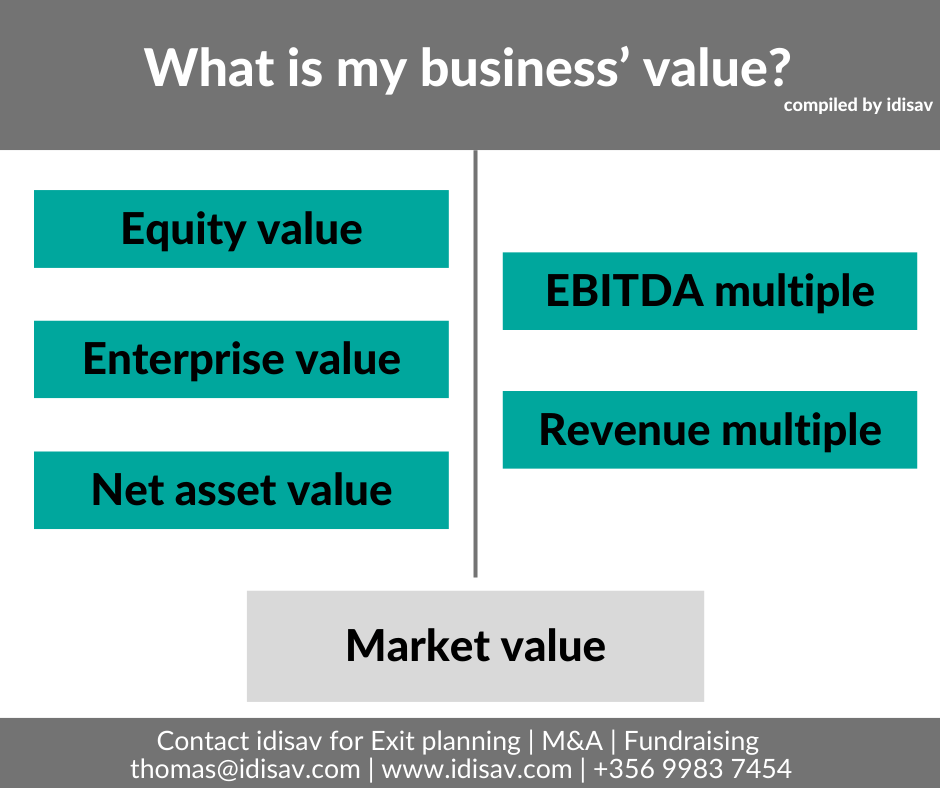

Business Valuations

When speaking with clients and prospects during their exit planning journey, the value of their business is often a key topic of discussion. A valuation exercise helps assess whether they have the financial freedom to move on from their business and embrace their next stage in life. It also sets a foundation for pricing expectationsContinue reading “Business Valuations”

Multiple arbitrage

‘Multiple arbitrage’ is a method often employed by private equity firms in their buy-and-build strategies. Though it has also been utilised (in Malta) in the pharmacy and grocery sector. Do you think your firm can benefit from multiple arbitrage to increase shareholder value?

Exit solution

Not all businesses are the same, and even those operating in the same sector. Though when it comes to exit planning, apart from a liquidation, it is crucial that the business is positioned to attract the right type of acquirer/s to achieve the optimal value for the owner. In certain cases this may be possibleContinue reading “Exit solution”

Can a minority shareholder cash-out?

Introduction While there is strength in unity, it is often a case that shareholders have different goals for their respective share ownership, particularly as they consider their options for an exit strategy. A listed company provides a simplified exit route being that one merely needs to place a sell order on their shareholding, though aContinue reading “Can a minority shareholder cash-out?”

Malta heads to further business consolidations!

Where are we? Business in Malta is heading for further consolidation in a number of industries, due to a host of factors that include family succession not being an option, industry specialisation, increased regulatory considerations, new market entrants, and changing cultural sentiments. Family succession not being an option As the business owners who founded theirContinue reading “Malta heads to further business consolidations!”