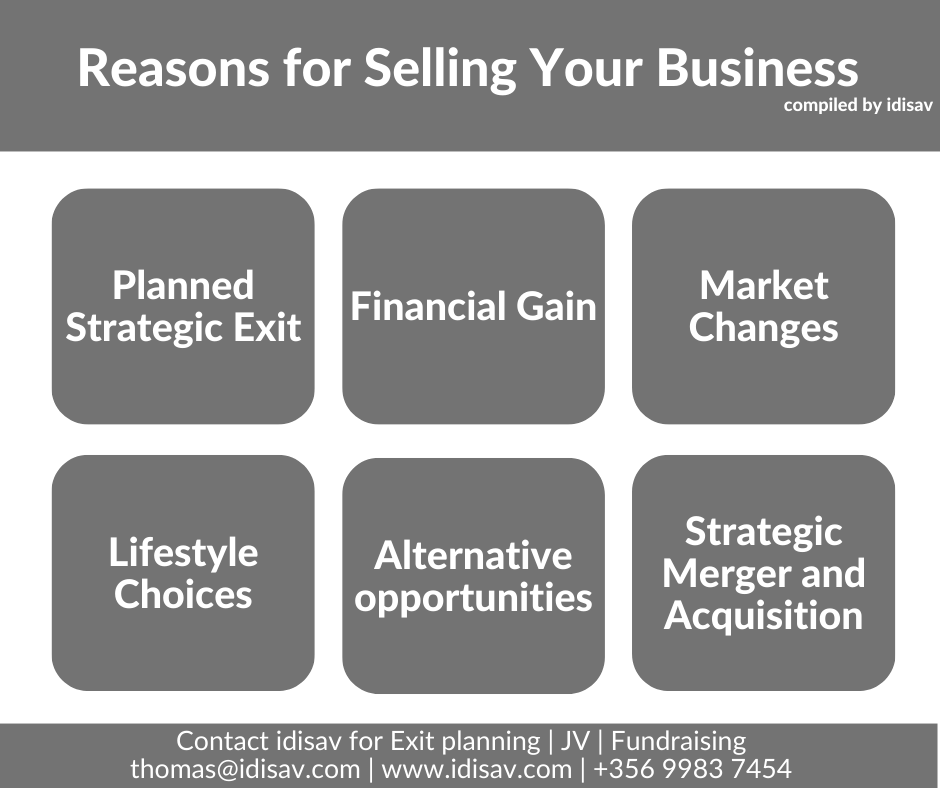

Occasionally, when assisting business owners who are considering possibly exiting their company, they are faced with the typical misconception that a person selling their business is a sign of a failed business. In fact, this is a misinterpretation of what is a natural progression in a company’s journey. There are a host of reasons forContinue reading “Reasons for Selling Your Business: Strategic Exit, Financial Gain, and More”

Category Archives: Uncategorized

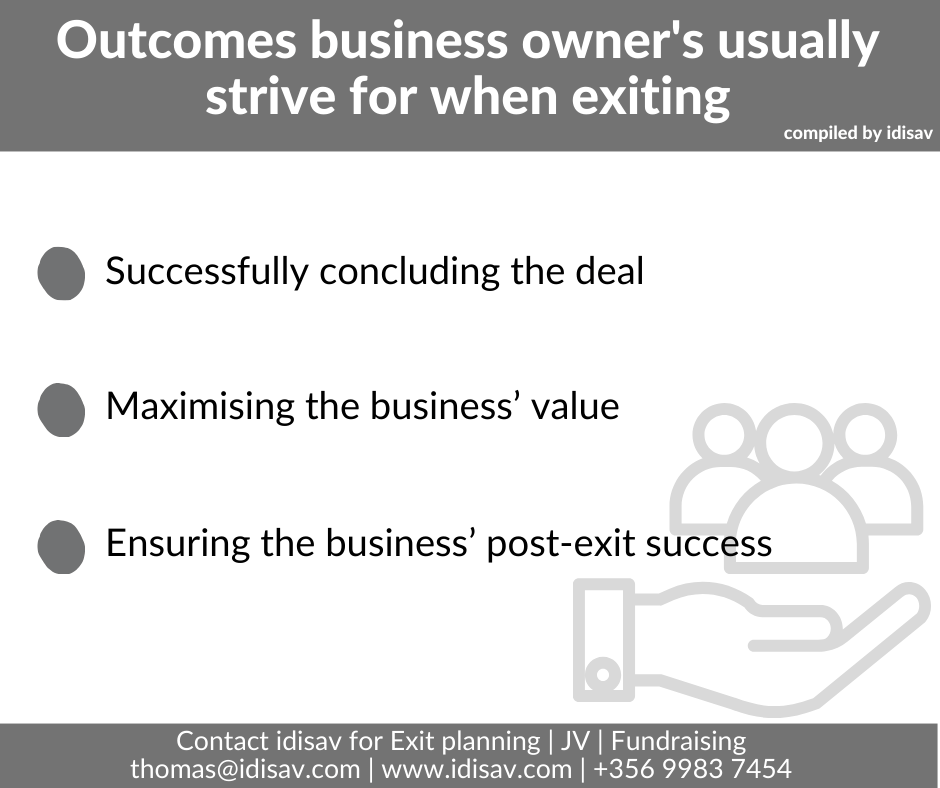

Optimising Business Exit Goals 🚀

A deep dive into accountancy firms’ Transparency Reports

The implementation of Transparency Reports instils stakeholders with increased confidence in the accounting profession on the basis of the accountants’ and auditors’ declarations. Such reports empower readers to make informed decisions, assured that their interests are safeguarded, and that auditors maintain independence, avoiding undue influence from any specific client’s financial significance. What is a transparencyContinue reading “A deep dive into accountancy firms’ Transparency Reports”

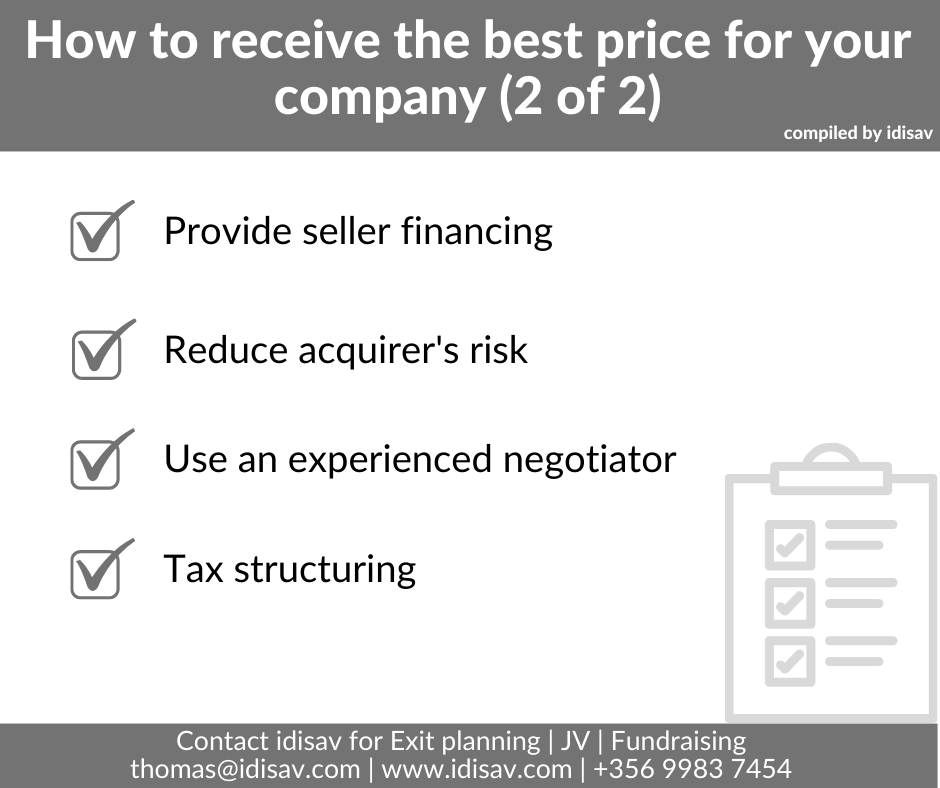

💼 Elevate Your Company’s Sale Value! 💼

Wondering how to secure the best price for your company? Here’s a strategic roadmap: 1️⃣ Leverage Seller Financing: Enhance buyer interest by offering seller financing. This not only attracts more potential buyers but also facilitates smoother negotiations. 💰 2️⃣ Mitigate Acquirer’s Risk: Position your company as a low-risk investment. Clear documentation, solid financials, and transparentContinue reading “💼 Elevate Your Company’s Sale Value! 💼”

Wishing you a Happy Easter!!

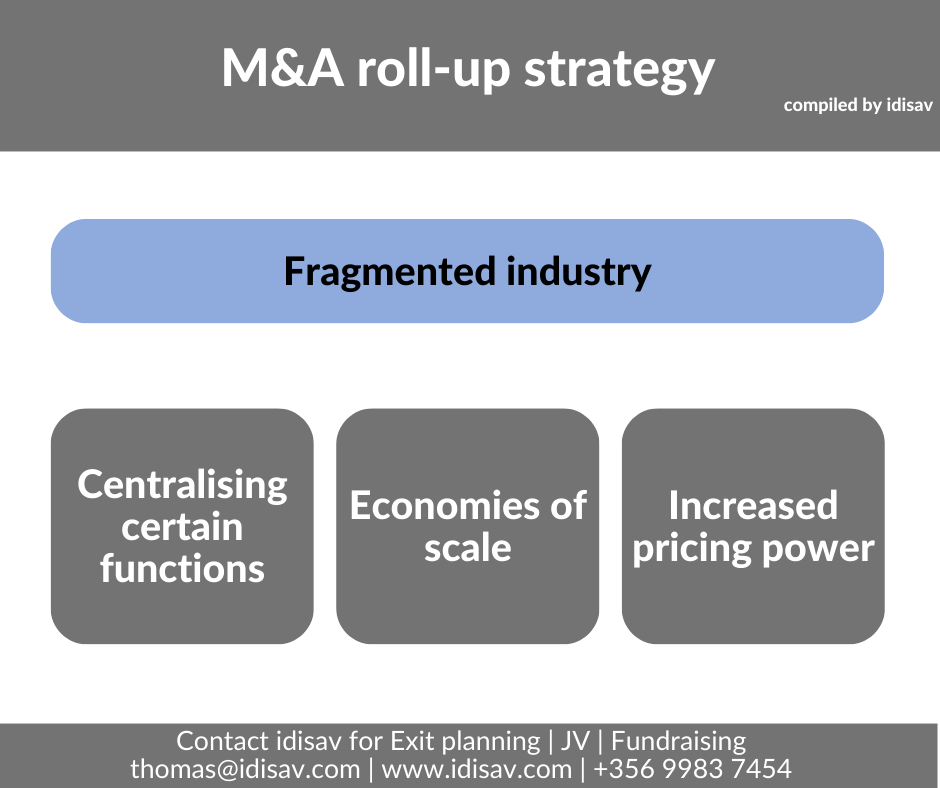

Latest publication: A Maltese M&A perspective on roll-up strategy

Thank you to the Malta Business Weekly for publishing! https://maltabusinessweekly.com/a-maltese-ma-perspective-on-roll-up-strategy/25623/

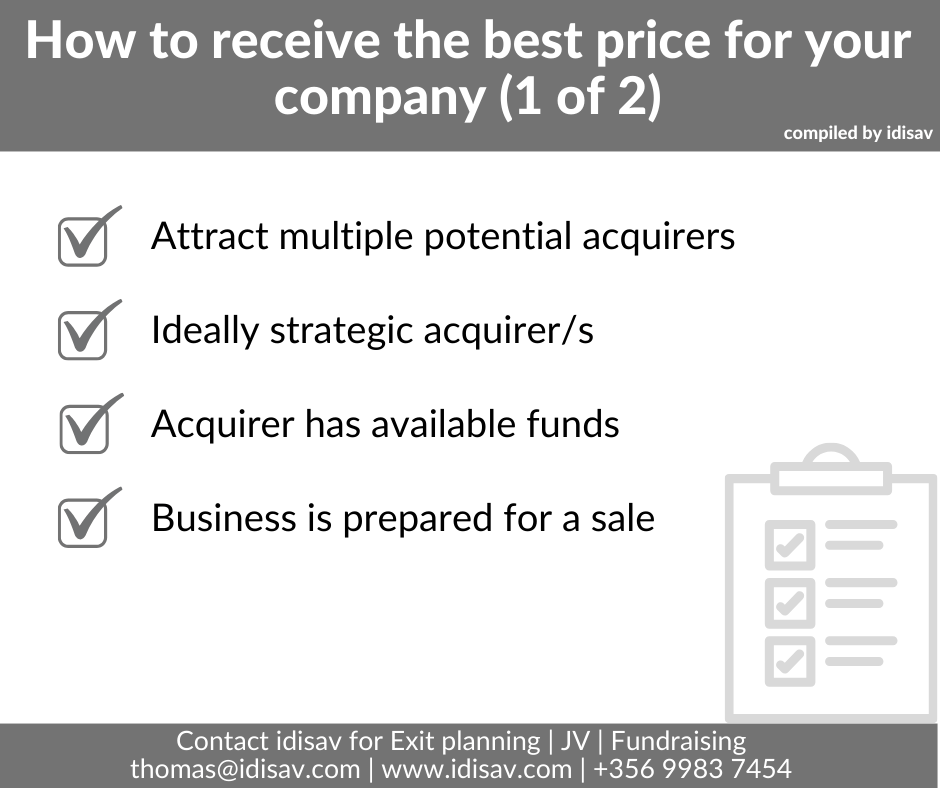

🌐 Unlock Optimal Valuation for Your Business Sale! 🌐

Curious about achieving the most favourable price for your company? Here’s a strategic blueprint: 1️⃣ Attract a Diverse Array of Potential Acquirers: Cultivate a broad interest base to generate healthy competition and drive up the value of your business. 🚀2️⃣ Prioritise Strategic Acquirers: Identify entities that recognize the intrinsic value and synergy of your business.Continue reading “🌐 Unlock Optimal Valuation for Your Business Sale! 🌐”

A Maltese M&A perspective on roll-up strategy

One of the recognised merger and acquisition frameworks is referred to as the ‘roll-up strategy’. Such a strategy is often prevalent in fragmented industries whereby a company expands its operations by acquiring smaller companies. Prominent Maltese examples that have adopted this strategy are evident in the pharmacy and grocery store sectors, where fragmented owner-operated enterprisesContinue reading “A Maltese M&A perspective on roll-up strategy”

🚀 Ready to Plan Your Business Exit? 🌐

👋 If you’re considering the next chapter and asking yourself questions like: ✨ Why take the next step? 🤔 Who am I beyond the business? 🌟 What’s my vision outside the business? It’s time to craft your exit strategy with idisav! 📈 Let’s navigate this journey together and ensure your business legacy aligns with yourContinue reading “🚀 Ready to Plan Your Business Exit? 🌐”

🌐 Exploring an Acquisition? 🚀 Check out why you need a “Teaser” Document! 📈

👋 Considering approaching potential acquirers on a confidential basis? Dive into the world of “teaser” documents with idisav. 🌐 1️⃣ No Names: Maintaining confidentiality until the perfect moment. 2️⃣ Unleash Growth Potential: Showcase your business’s growth prospects in a snapshot. A compelling teaser document sets the stage for a deeper exploration. 3️⃣ Financial Snapshot: HighlightContinue reading “🌐 Exploring an Acquisition? 🚀 Check out why you need a “Teaser” Document! 📈”