🌟 Selling your company? Consider Seller Financing for a smoother journey! 🚀 Here’s why: Ready to explore these benefits? Contact us on thomas@idisav.com or +356 9983 7454 for guidance on your acquisition or exit strategy. 📧 Let’s make your business transition a success! 💡✨ #ExitPlanning #BusinessAcquisition #DealStructures #Strategy #BusinessBroker #Entrepreneurship #ExitStrategy #Merger #Acquisition #Consultancy #AccountantsContinue reading “Seller financing considerations when selling your company”

Tag Archives: accountants

Deal structures when acquiring a company

🚀 Exploring company acquisition? Discover diverse deal structures to shape your business future! 💼 Here are some options: Ready to explore these options? Contact idisav on thomas@idisav.com or +356 9983 7454 for expert guidance on your acquisition or exit strategy. 📧 Let’s shape your success story! 💡✨

Due diligence on human resources and employees relations

📌 Considering an acquisition or exit strategy? Don’t overlook the importance of due diligence on human resources and employee relations! 🔍 Here are key factors to consider: 🏢 Organisational Structure: Understand the foundation for effective operations. 📊 Accuracy of Employment Records: Ensure a smooth transition with precise information. 💰 Employee Benefits and Compensation: Evaluate theContinue reading “Due diligence on human resources and employees relations”

Due diligence on a product distributor’s operations

🤔 Considering an acquisition in the FMCG industry or exploring new product distribution opportunities? Here are key due diligence steps to guide your decision-making: 🔍 Evaluate operational efficiencies, including inventory management, supply chain, and logistics. 💼 Assess relationships with suppliers and scrutinize their terms for a seamless collaboration. 🌐 Review the distribution network, warehouse facilities,Continue reading “Due diligence on a product distributor’s operations”

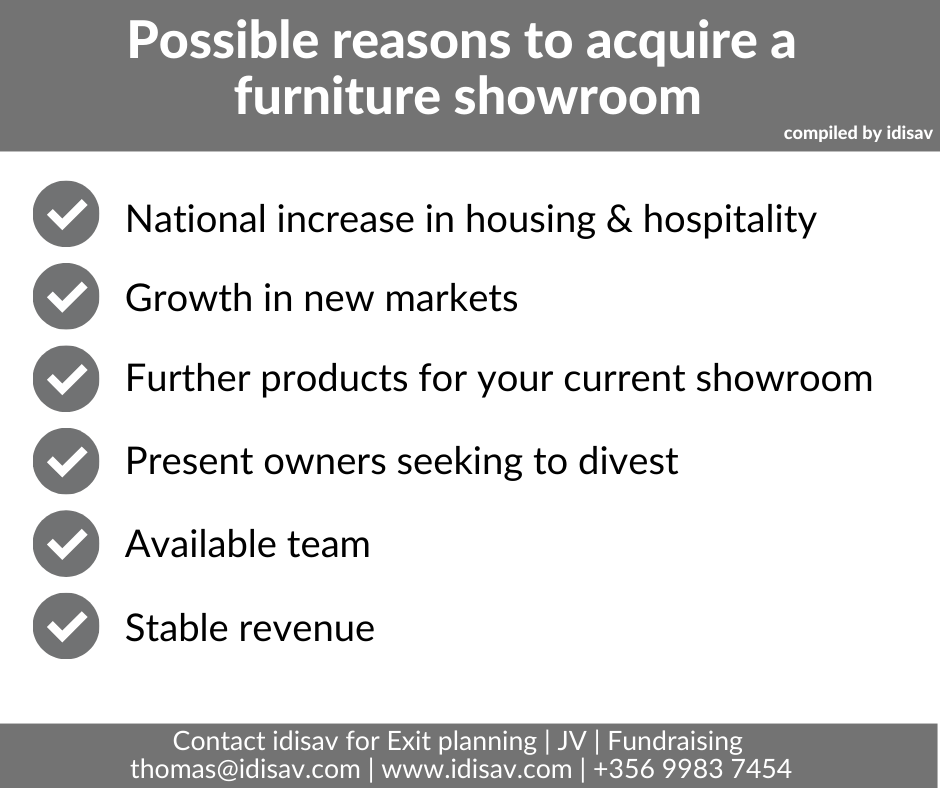

Possible reasons to acquire a furniture showroom

Whilst there may be varied reasons to acquire a business, one particular sector that may be of interest could be a #furniture #showroom and this may be due to: 🏡Increase in housing stock 🌍Seeking to expand into a new market 💼Stable revenues of a mature business 🔄Synergies with a related showroom you currently own 🌟CurrentContinue reading “Possible reasons to acquire a furniture showroom”

Legal documentation considerations when acquiring a business

Considering an acquisition or exit strategy? 🤔 Here are key legal documentation considerations you shouldn’t overlook: Navigating these legal aspects can be complex, but fear not! 💼 Contact http://www.idisav.com to get expert assistance for your acquisition or exit strategy. 📧 Their team is ready to guide you through the process and ensure a smooth transition.Continue reading “Legal documentation considerations when acquiring a business”

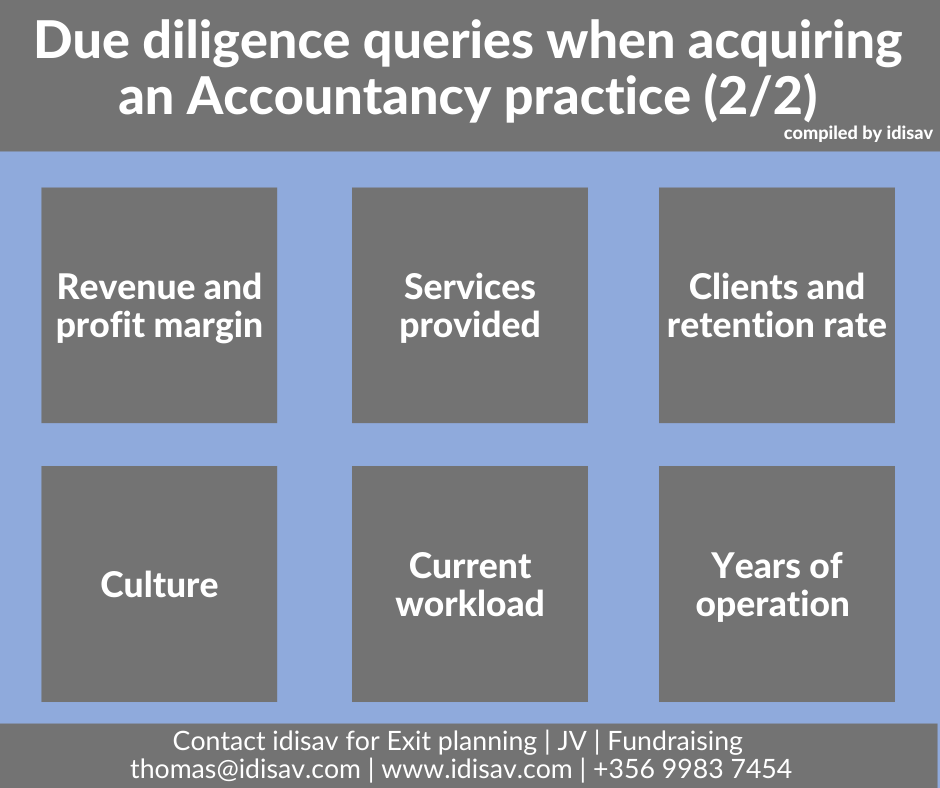

Due diligence queries when acquiring an Accountancy practice

Whilst acquiring a profitable Accountancy practice may be preferred there are a number of other due diligence considerations, such as: 💰 Revenue and profit margin 🛠️ Services provided 🤝 Clients and retention rate 🌐 Culture 📊 Current workload 📆 Years of operation Contact http://www.idisav.com to assist with your acquisition or exit strategy #exit#planning#strategy#buy#business#broker#Malta#entrepreneur#sell#exitplanning#merger#acquisition#consultant#accountants

Due diligence queries when acquiring an Accountancy practice (1/2)

When acquiring a business due diligence is a fundamental part of the process to get to know the target firm. In relation to acquiring an accountancy practice, (part 1 of 2) you should consider assessing its: 🚀 Business development 📚 Legal & regulatory issues 💰 Financial history 👥 Employees 💼 Motivation for selling 🌐 ReputationContinue reading “Due diligence queries when acquiring an Accountancy practice (1/2)”