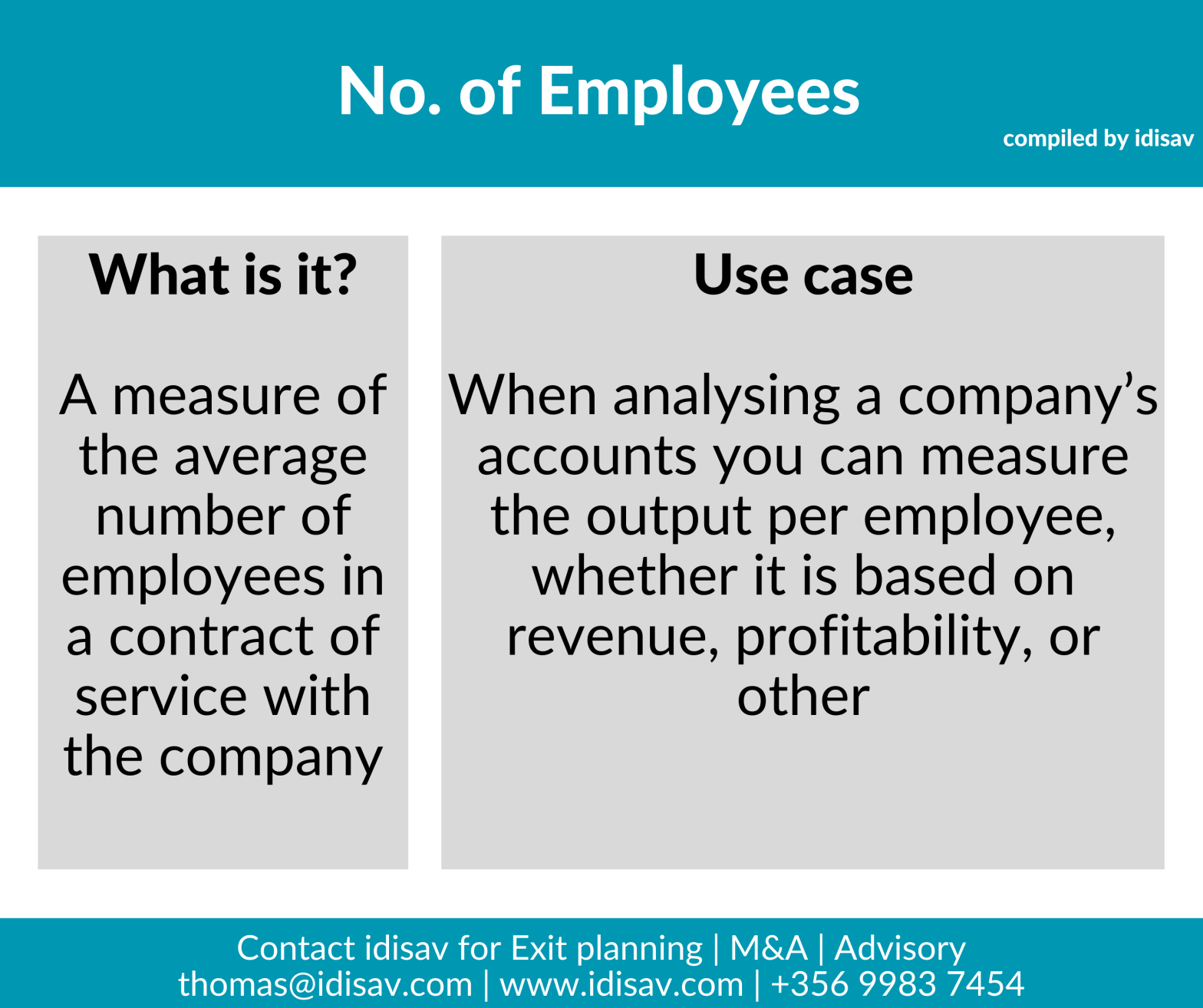

I’m often surprised by how many companies overlook employee productivity analysis. Start including it in your management accounts to drive better decisions and optimise growth. Employee KPIs, like revenue per employee and turnover rates, are key to measuring workforce efficiency and productivity. 👥📈

Tag Archives: business

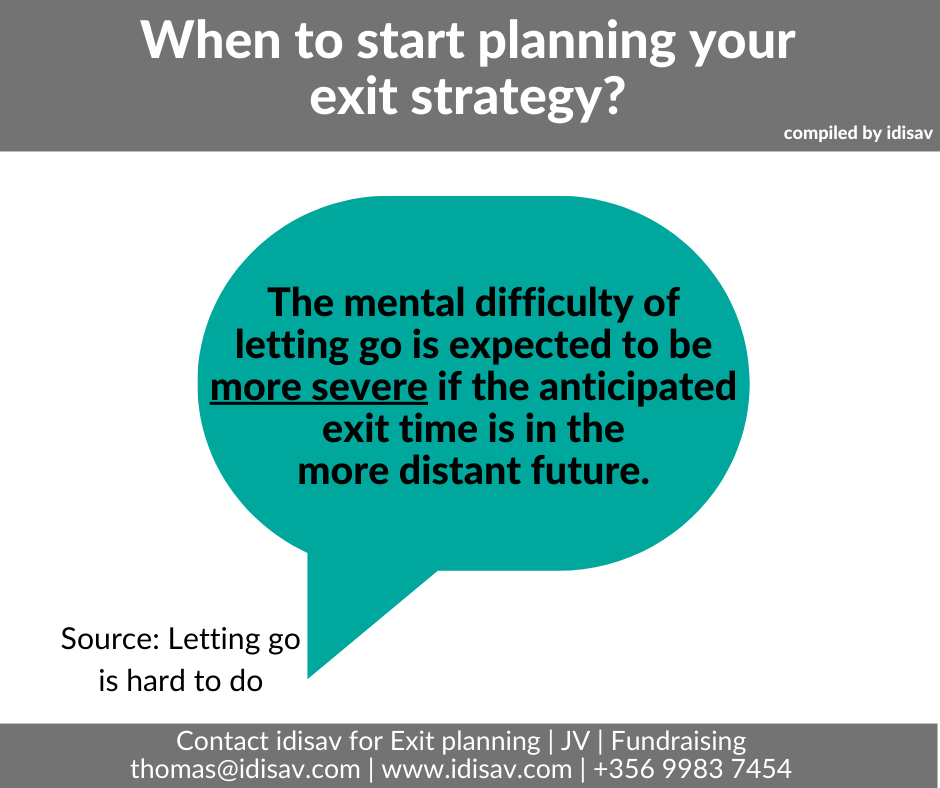

When’s best to exit?

Extract from ‘Letting go is hard to do’: The results show that the mental difficulty of letting go is expected to be more severe if the anticipated exit time is in the more distant future. A plausible explanation is that the respondents planning exit in the near future have already addressed the issues of givingContinue reading “When’s best to exit?”

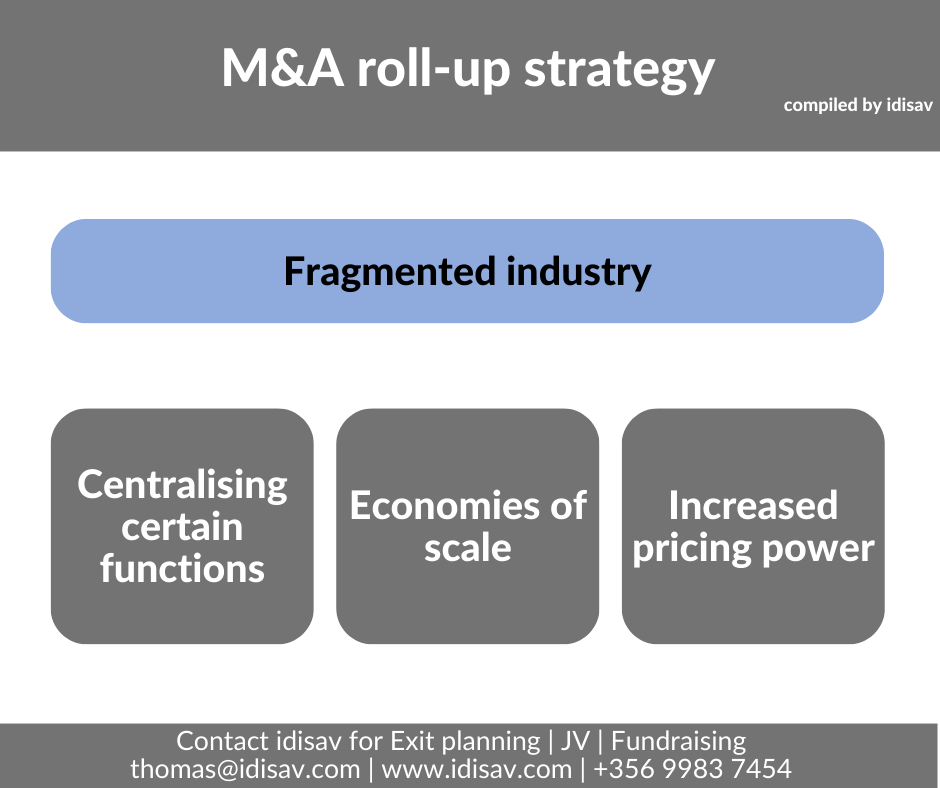

A Maltese M&A perspective on roll-up strategy

One of the recognised merger and acquisition frameworks is referred to as the ‘roll-up strategy’. Such a strategy is often prevalent in fragmented industries whereby a company expands its operations by acquiring smaller companies. Prominent Maltese examples that have adopted this strategy are evident in the pharmacy and grocery store sectors, where fragmented owner-operated enterprisesContinue reading “A Maltese M&A perspective on roll-up strategy”

Structuring a deal when business partners split

Business partnerships usually get off the ground with great enthusiasm and fanfare, but the separation of such a partnership can be a source of tension, fraught with difficulty, and time-consuming. This separation process may lead to a series of stop-start negotiations and other frustrations. In the scenario where the parties have already agreed on aContinue reading “Structuring a deal when business partners split”

Exploring the M&A landscape: Which is the most acquisitive accountancy firm?

Throughout the years, local accountancy practices have had to adapt to a host of challenges from increased specialisation and limited human resources to stringent regulatory requirements. This has led to a preference for firms to consider mergers or acquisitions for their established practices. The recent mergers and acquisitions in the accountancy sector have centred onContinue reading “Exploring the M&A landscape: Which is the most acquisitive accountancy firm?”

Navigating Employee Buyouts: Challenges and Strategies

When I had considered selling my first business, I had quietly broached the idea with my key employees if they would consider taking on an ownership stake in the business. For one reason or another they had individually indicated to me that there was not a firm interest in taking on a shareholding and theContinue reading “Navigating Employee Buyouts: Challenges and Strategies”

Negotiation considerations when acquiring a business

In the process to acquire a business, one may need to negotiate and this may consist of: 💰 Price and Payment Terms 🤝 📦 Assets and Inventory 📊 ⚖️ Debts & Liabilities 💸 ⏳ Transition Period 🔄 🚫 Non-compete Agreement 👥 📝 Due Diligence and Contingencies 🕵️♂️ Contact thomas@idisav.com | +356 9983 7454 to assistContinue reading “Negotiation considerations when acquiring a business”

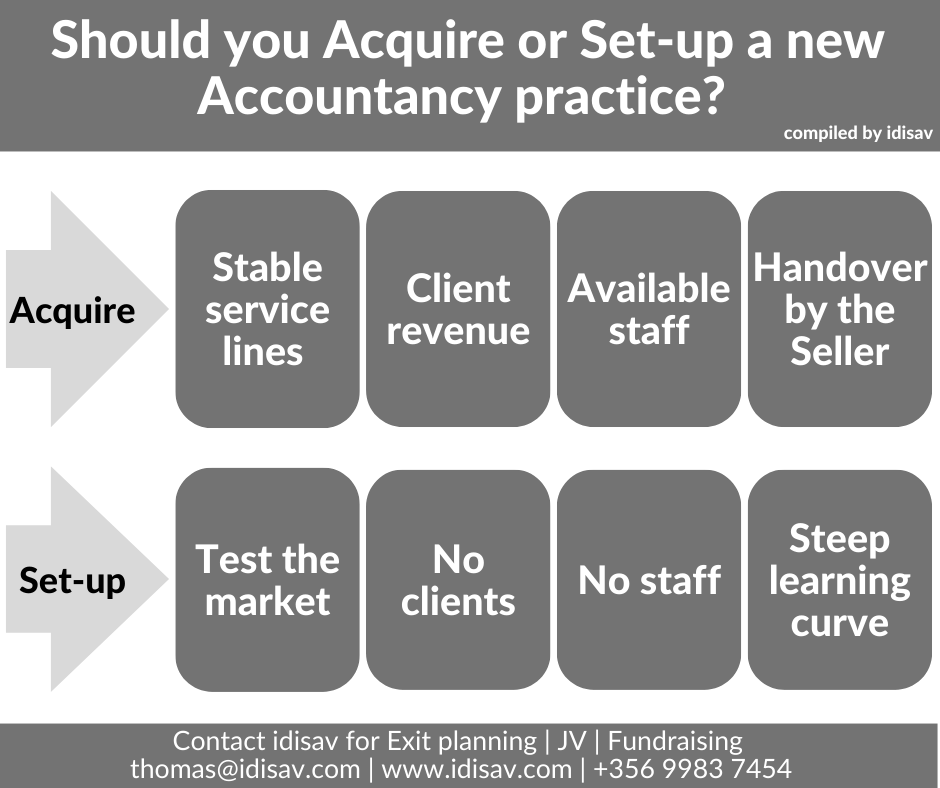

Should you Acquire or Set-up your Accountancy practice?

Why would you want to set-up your own Accountancy practice when you can Acquire one? Stable service lines Client revenue Available staff Handover by the seller Contact us on thomas@idisav.com or +356 9983 7454 to assist with your acquisition or exit strategy

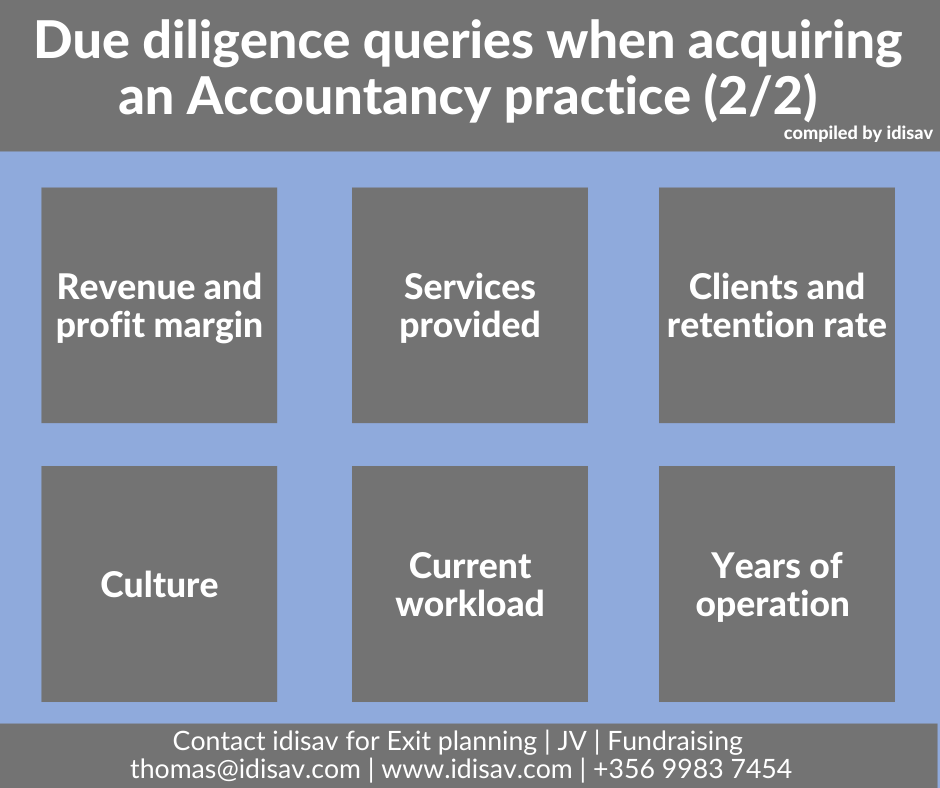

Due diligence queries when acquiring an Accountancy practice

Whilst acquiring a profitable Accountancy practice may be preferred there are a number of other due diligence considerations, such as: 💰 Revenue and profit margin 🛠️ Services provided 🤝 Clients and retention rate 🌐 Culture 📊 Current workload 📆 Years of operation Contact http://www.idisav.com to assist with your acquisition or exit strategy #exit#planning#strategy#buy#business#broker#Malta#entrepreneur#sell#exitplanning#merger#acquisition#consultant#accountants

Due diligence queries when acquiring an Accountancy practice (1/2)

When acquiring a business due diligence is a fundamental part of the process to get to know the target firm. In relation to acquiring an accountancy practice, (part 1 of 2) you should consider assessing its: 🚀 Business development 📚 Legal & regulatory issues 💰 Financial history 👥 Employees 💼 Motivation for selling 🌐 ReputationContinue reading “Due diligence queries when acquiring an Accountancy practice (1/2)”