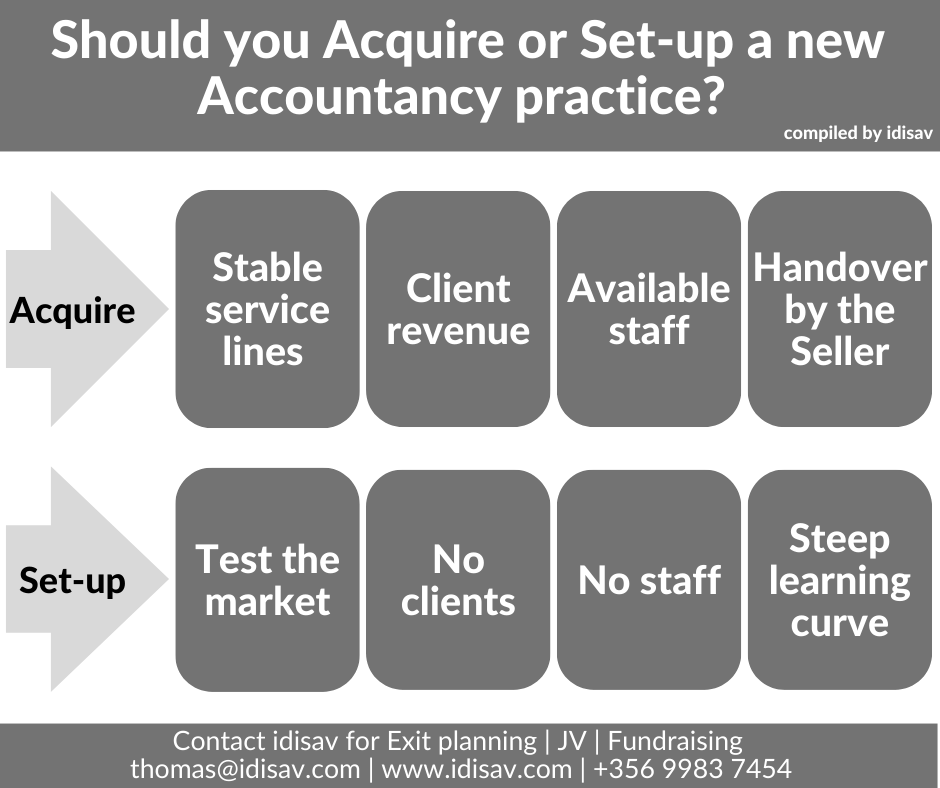

Why would you want to set-up your own Accountancy practice when you can Acquire one? Stable service lines Client revenue Available staff Handover by the seller Contact us on thomas@idisav.com or +356 9983 7454 to assist with your acquisition or exit strategy

Tag Archives: entrepreneur

Due diligence queries when acquiring an Accountancy practice (1/2)

When acquiring a business due diligence is a fundamental part of the process to get to know the target firm. In relation to acquiring an accountancy practice, (part 1 of 2) you should consider assessing its: 🚀 Business development 📚 Legal & regulatory issues 💰 Financial history 👥 Employees 💼 Motivation for selling 🌐 ReputationContinue reading “Due diligence queries when acquiring an Accountancy practice (1/2)”

Reasons to acquire an Accountancy practice

With many accountants approaching retirement or seeking to expand there may be an opportunity to acquire your own Accountancy practice. Some benefits include: Established clientele Proven systems Reputable brand New service lines Team Economies of scale Contact http://www.idisav.com to assist with your acquisition or exit strategy

Reasons for Selling Your Business: Strategic Exit, Financial Gain, and More

Reasons for Selling Your Business: Strategic Exit, Financial Gain, and More

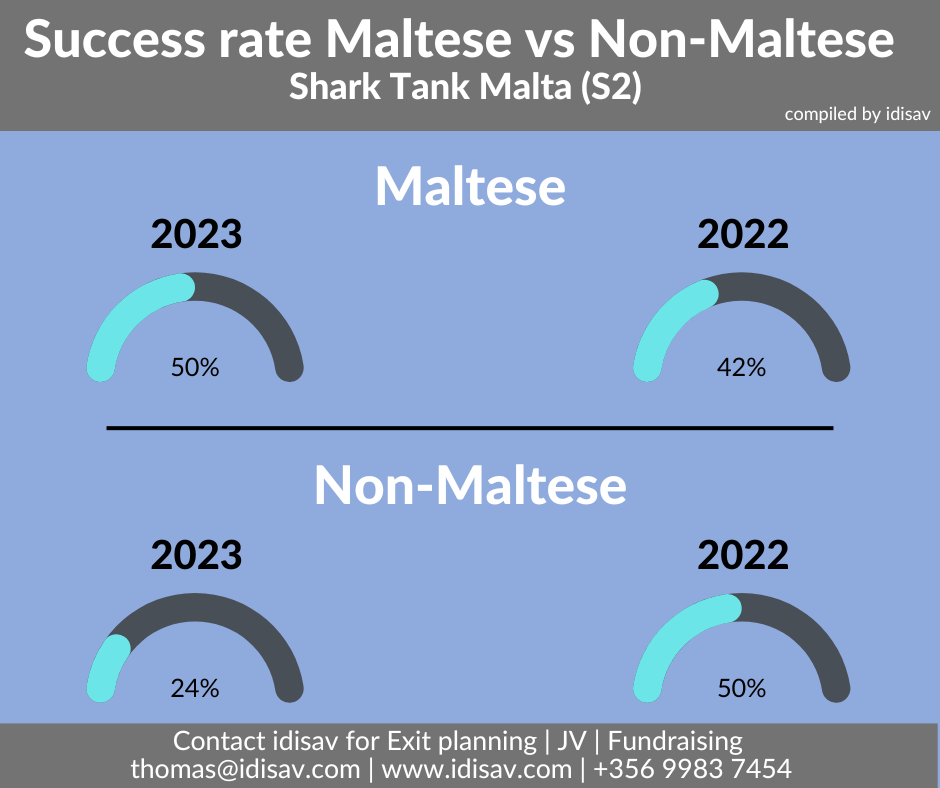

Shark Tank stats —>> Success rate for Maltese and Non-Maltese

Contact idisav for early-stage fundraising💲 Entrepreneurs keep building🥸🤓 We watched Shark Tank Malta Season 2 and these are idisav’s observations. #sharktank #sharktankmalta #Malta #entrepreneur #fundraising #business

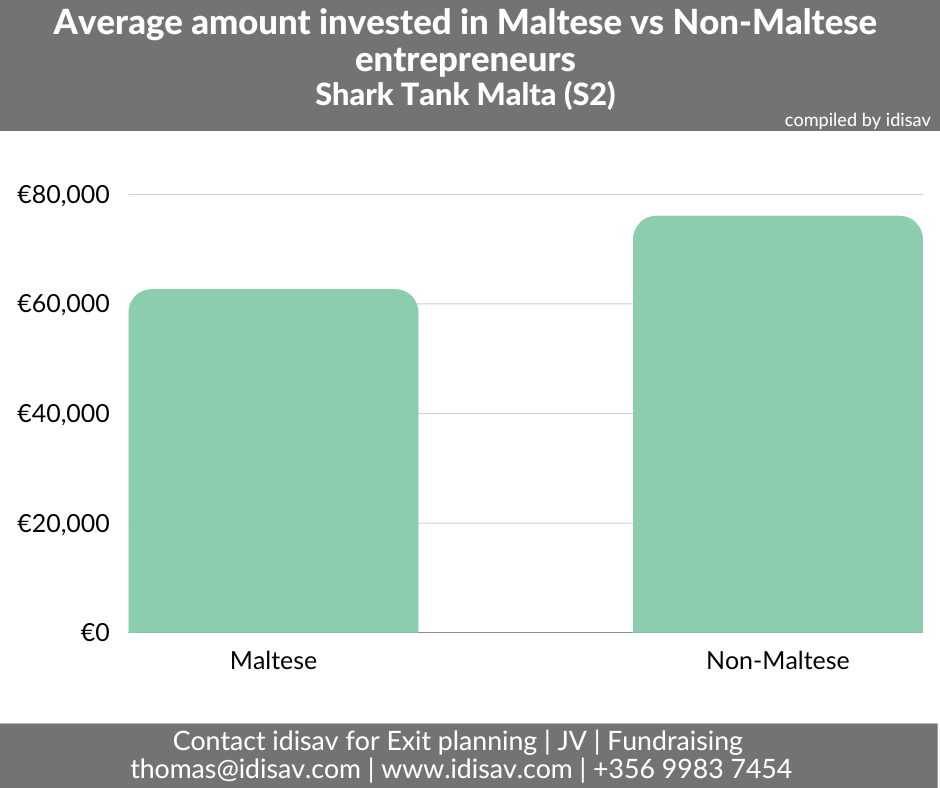

Shark Tank stats: Non-Maltese managed to secure slightly more money per successful pitch 💸

Contact idisav for early-stage fundraising💲 Entrepreneurs keep building🥸🤓 We watched Shark Tank Malta Season 2 and these are idisav’s observations. #sharktank #sharktankmalta #Malta #entrepreneur #fundraising #business

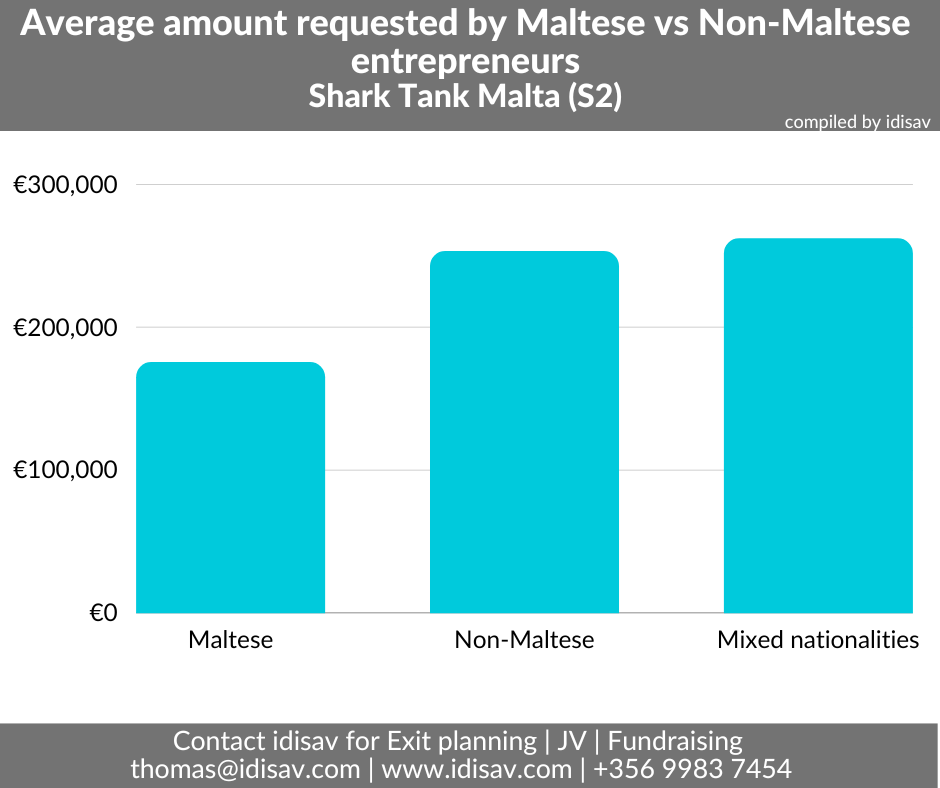

Shark Tank Malta Stats —>> Non-Maltese consistently requested more money than Maltese

Contact idisav for early-stage fundraising💲 Entrepreneurs keep building🥸🤓 We watched Shark Tank Malta Season 2 and these are idisav’s observations. #sharktank #sharktankmalta #Malta #entrepreneur #fundraising #business

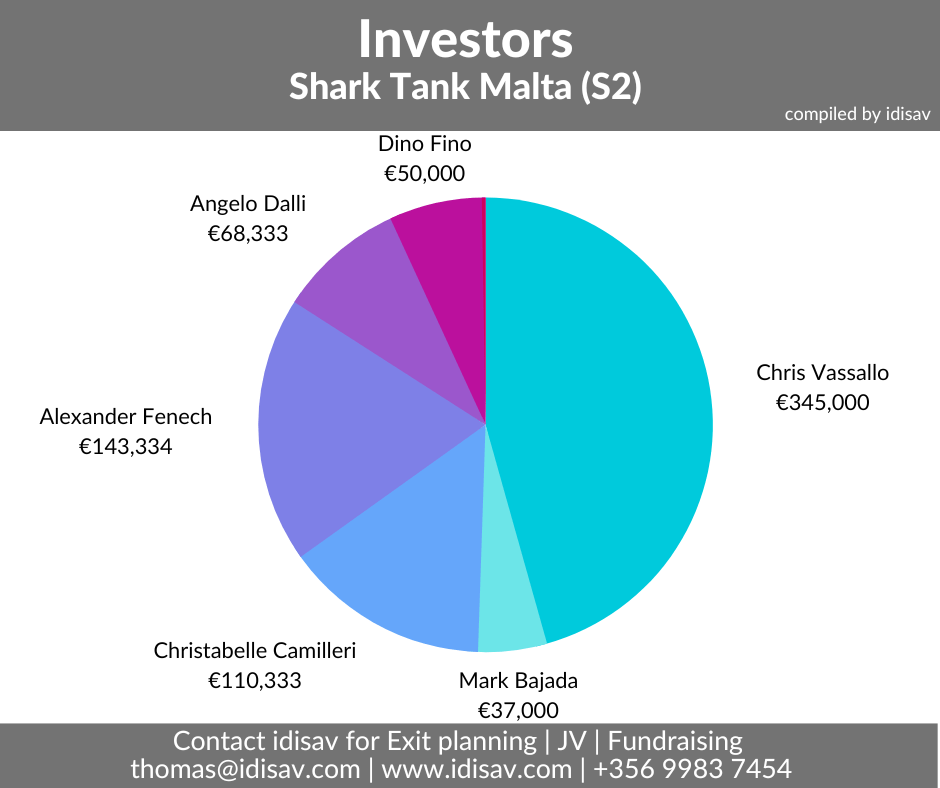

Some Sharks invested more than others, in particular, Chris Vassallo💸💸💸

Contact idisav for early-stage fundraising💲 Entrepreneurs keep building🥸🤓 We watched Shark Tank Malta Season 2 and these are idisav’s observations. #sharktank #sharktankmalta #Malta #entrepreneur #fundraising #business

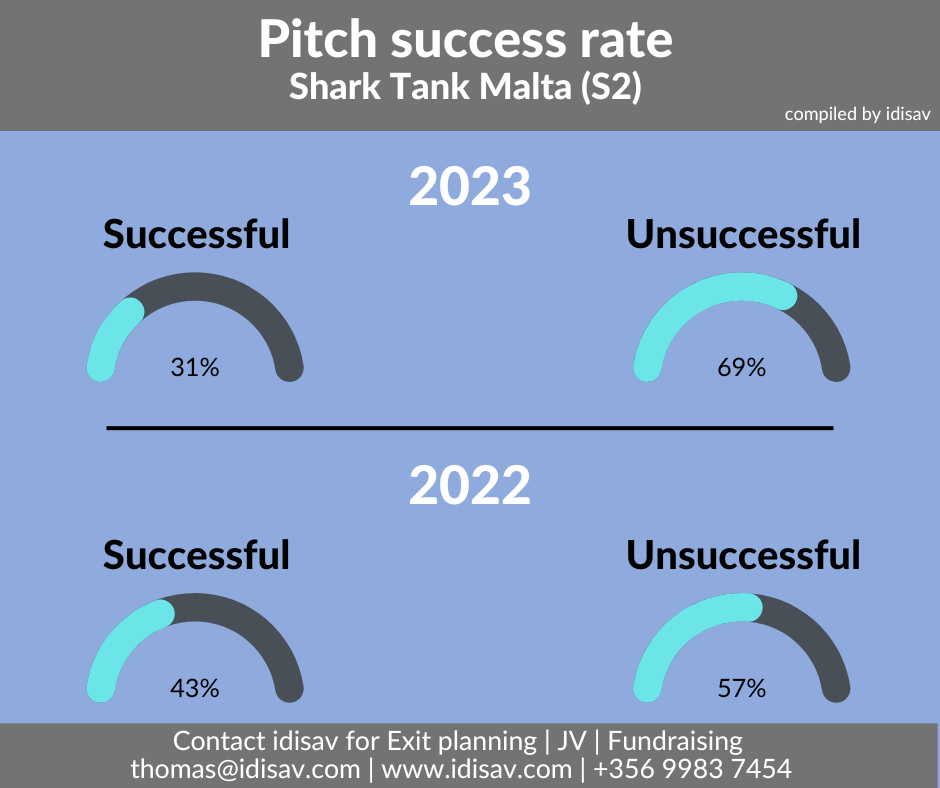

How successful where this season’s pitches? 🤔🤯

Contact idisav for early-stage fundraising💲 Entrepreneurs keep building🥸🤓 We watched Shark Tank Malta Season 2 and these are Idisav observations. #sharktank #sharktankmalta #Malta #entrepreneur #fundraising #business #pitch #success

Should you inform your employees that you are selling the business?

“Take our 20 best people away, and I tell you that Microsoft would become an unimportant company.” – Bill Gates Every business owner is guaranteed to have to exit their company at a certain stage. The only choice is whether it will be a planned or unplanned exit. In relation to this, the business ownerContinue reading “Should you inform your employees that you are selling the business?”