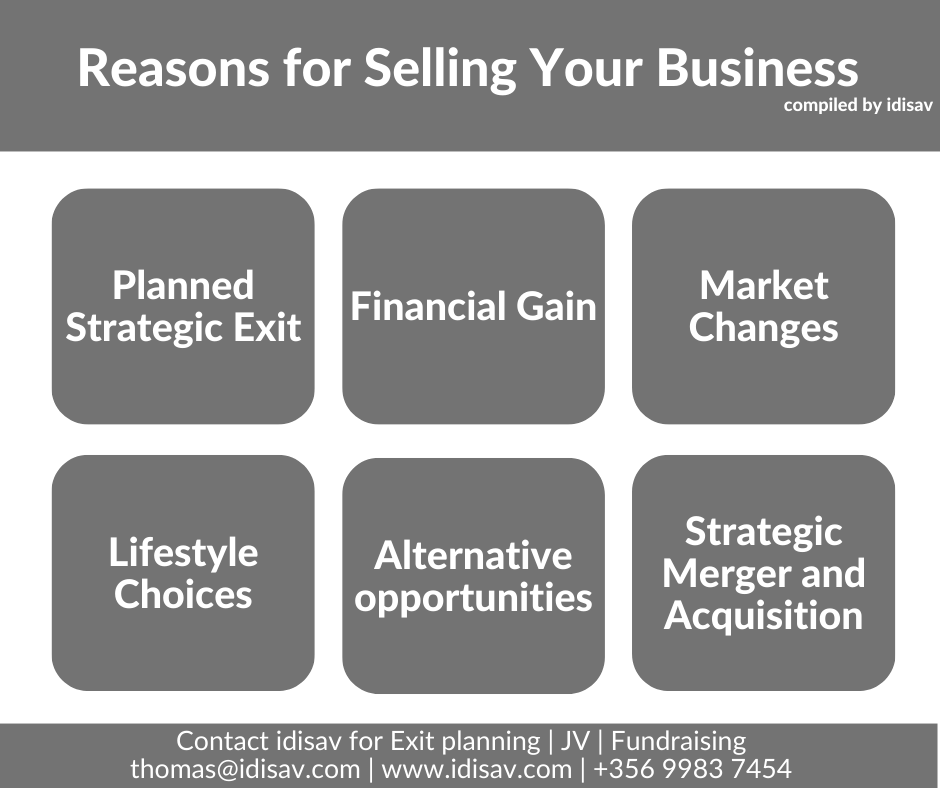

Occasionally, when assisting business owners who are considering possibly exiting their company, they are faced with the typical misconception that a person selling their business is a sign of a failed business. In fact, this is a misinterpretation of what is a natural progression in a company’s journey. There are a host of reasons forContinue reading “Reasons for Selling Your Business: Strategic Exit, Financial Gain, and More”

Tag Archives: exit

🔍 Considering Your Business Exit Strategy?

👋 Planning your business exit? It’s a big move, and at idisav, we’re here to break down the key options for you.1️⃣ Sell Your Business: Learn how to get your business sale-ready, attracting potential buyers.2️⃣ Merger: Explore the benefits and challenges of merging with another company strategically.3️⃣ Public listing: Taking your business public.4️⃣ Management Buyout:Continue reading “🔍 Considering Your Business Exit Strategy?”

Legal documentation considerations when acquiring a business

Considering an acquisition or exit strategy? 🤔 Here are key legal documentation considerations you shouldn’t overlook: Navigating these legal aspects can be complex, but fear not! 💼 Contact http://www.idisav.com to get expert assistance for your acquisition or exit strategy. 📧 Their team is ready to guide you through the process and ensure a smooth transition.Continue reading “Legal documentation considerations when acquiring a business”

Negotiation considerations when acquiring a business

In the process to acquire a business, one may need to negotiate and this may consist of: 💰 Price and Payment Terms 🤝 📦 Assets and Inventory 📊 ⚖️ Debts & Liabilities 💸 ⏳ Transition Period 🔄 🚫 Non-compete Agreement 👥 📝 Due Diligence and Contingencies 🕵️♂️ Contact thomas@idisav.com | +356 9983 7454 to assistContinue reading “Negotiation considerations when acquiring a business”

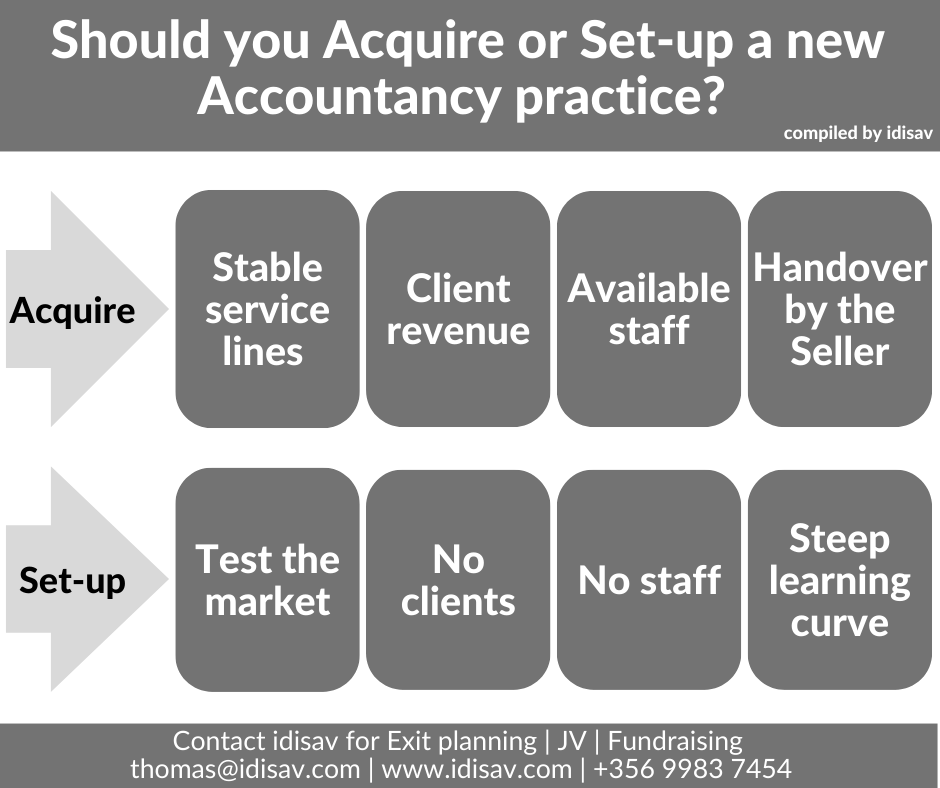

Should you Acquire or Set-up your Accountancy practice?

Why would you want to set-up your own Accountancy practice when you can Acquire one? Stable service lines Client revenue Available staff Handover by the seller Contact us on thomas@idisav.com or +356 9983 7454 to assist with your acquisition or exit strategy

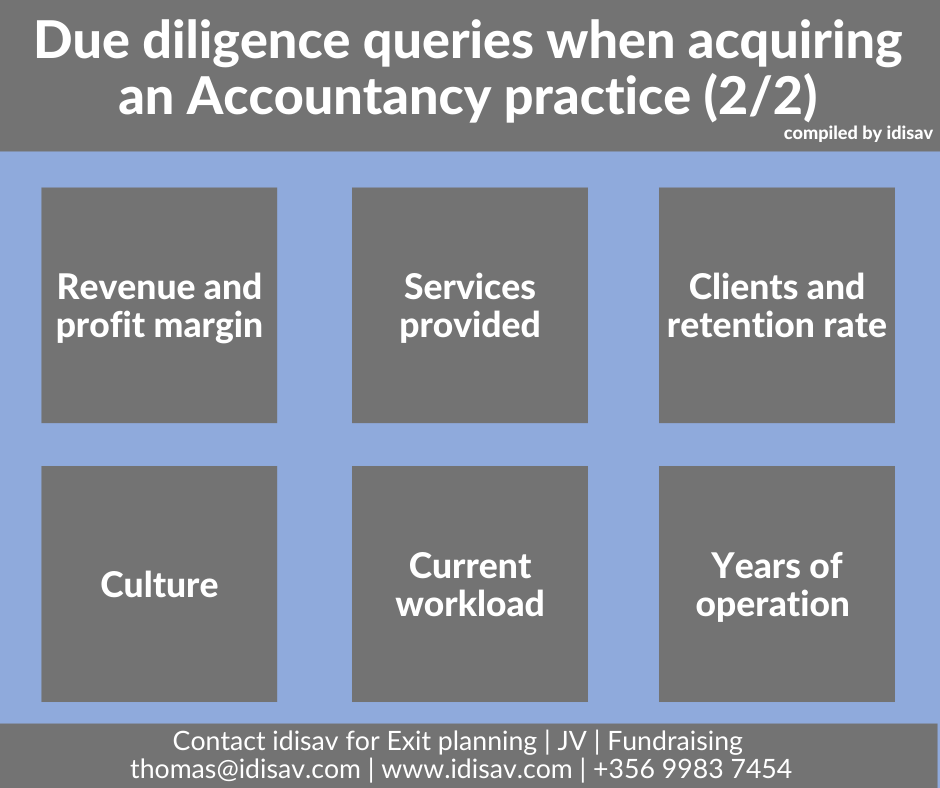

Due diligence queries when acquiring an Accountancy practice

Whilst acquiring a profitable Accountancy practice may be preferred there are a number of other due diligence considerations, such as: 💰 Revenue and profit margin 🛠️ Services provided 🤝 Clients and retention rate 🌐 Culture 📊 Current workload 📆 Years of operation Contact http://www.idisav.com to assist with your acquisition or exit strategy #exit#planning#strategy#buy#business#broker#Malta#entrepreneur#sell#exitplanning#merger#acquisition#consultant#accountants

Due diligence queries when acquiring an Accountancy practice (1/2)

When acquiring a business due diligence is a fundamental part of the process to get to know the target firm. In relation to acquiring an accountancy practice, (part 1 of 2) you should consider assessing its: 🚀 Business development 📚 Legal & regulatory issues 💰 Financial history 👥 Employees 💼 Motivation for selling 🌐 ReputationContinue reading “Due diligence queries when acquiring an Accountancy practice (1/2)”

Reasons to acquire an Accountancy practice

With many accountants approaching retirement or seeking to expand there may be an opportunity to acquire your own Accountancy practice. Some benefits include: Established clientele Proven systems Reputable brand New service lines Team Economies of scale Contact http://www.idisav.com to assist with your acquisition or exit strategy

Reasons for Selling Your Business: Strategic Exit, Financial Gain, and More

Reasons for Selling Your Business: Strategic Exit, Financial Gain, and More

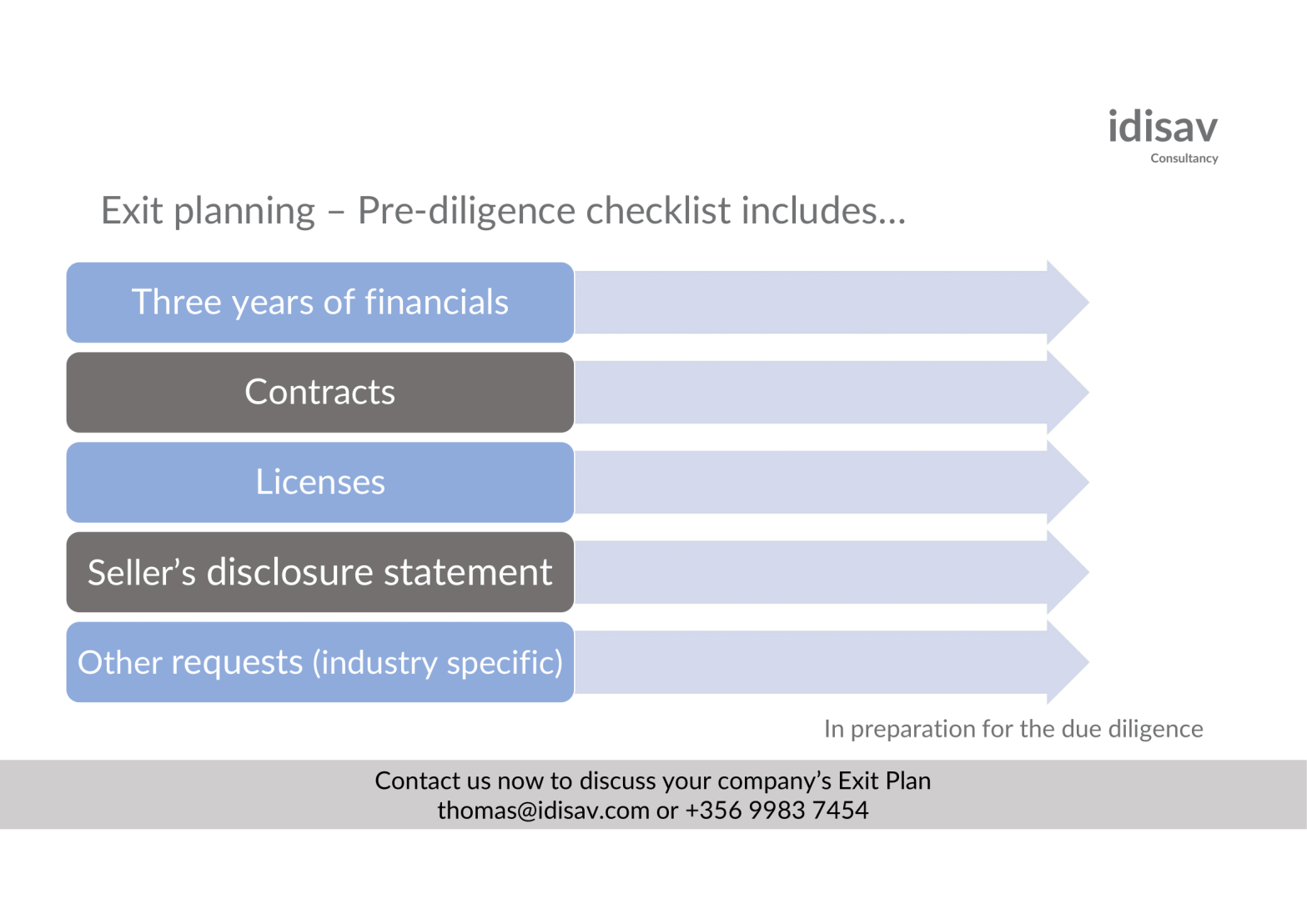

Exit planning – Set the Stage for your Due Diligence and a Successful Business Exit!

Feel free to contact idisav to discuss your exit strategy. idisav’s founder, Thomas J. Cremona, a qualified accountant and endurance athlete, has undertaken the exit process from an entrepreneur’s perspective with a company he had founded and successfully exited. +356 9983 7454 | http://www.idisav.com | thomas@idisav.com #exit #planning #buy #business #broker #Malta #Entrepreneurship #sell #ExitPlanningContinue reading “Exit planning – Set the Stage for your Due Diligence and a Successful Business Exit!”