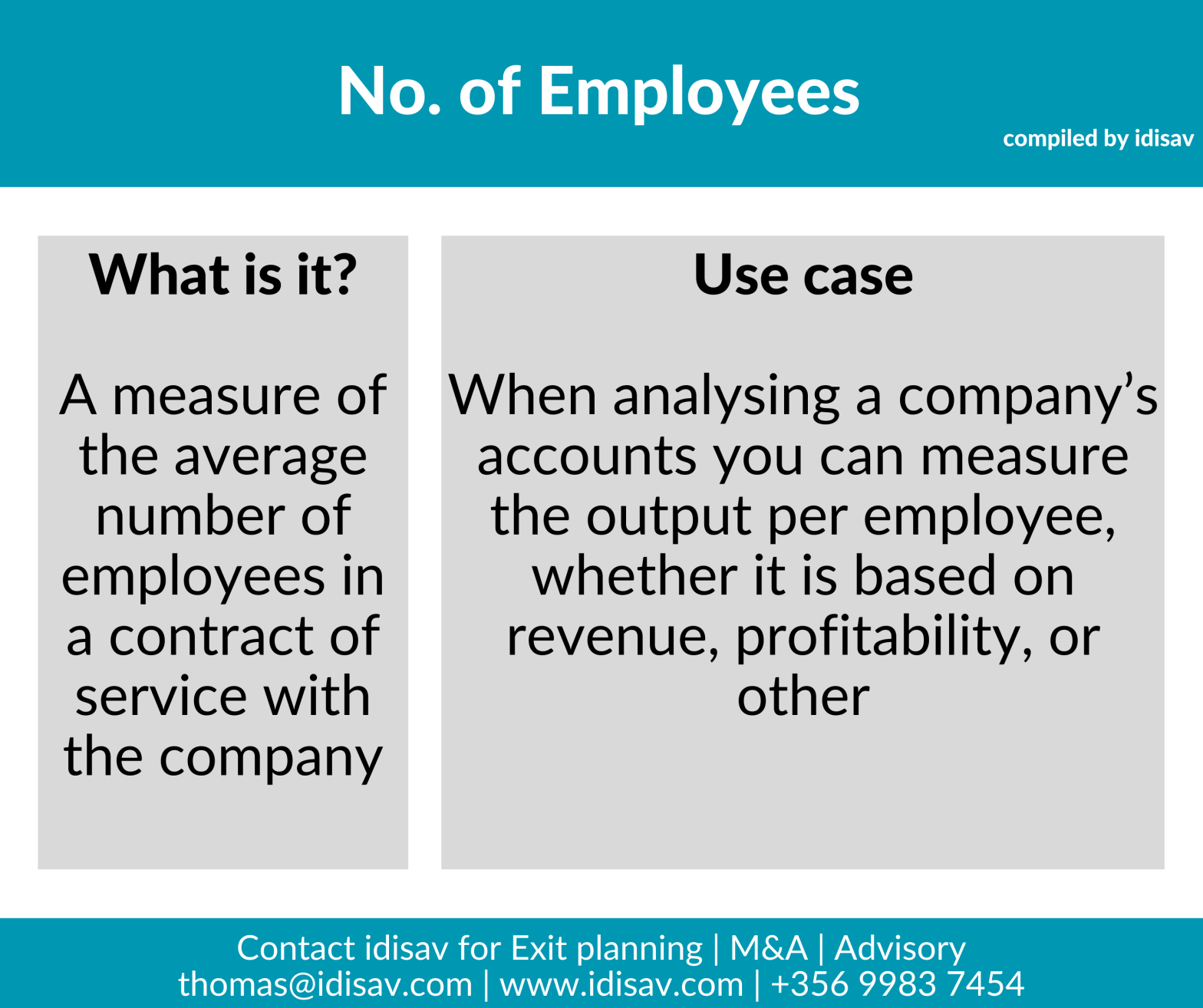

I’m often surprised by how many companies overlook employee productivity analysis. Start including it in your management accounts to drive better decisions and optimise growth. Employee KPIs, like revenue per employee and turnover rates, are key to measuring workforce efficiency and productivity. 👥📈

Tag Archives: exit planning

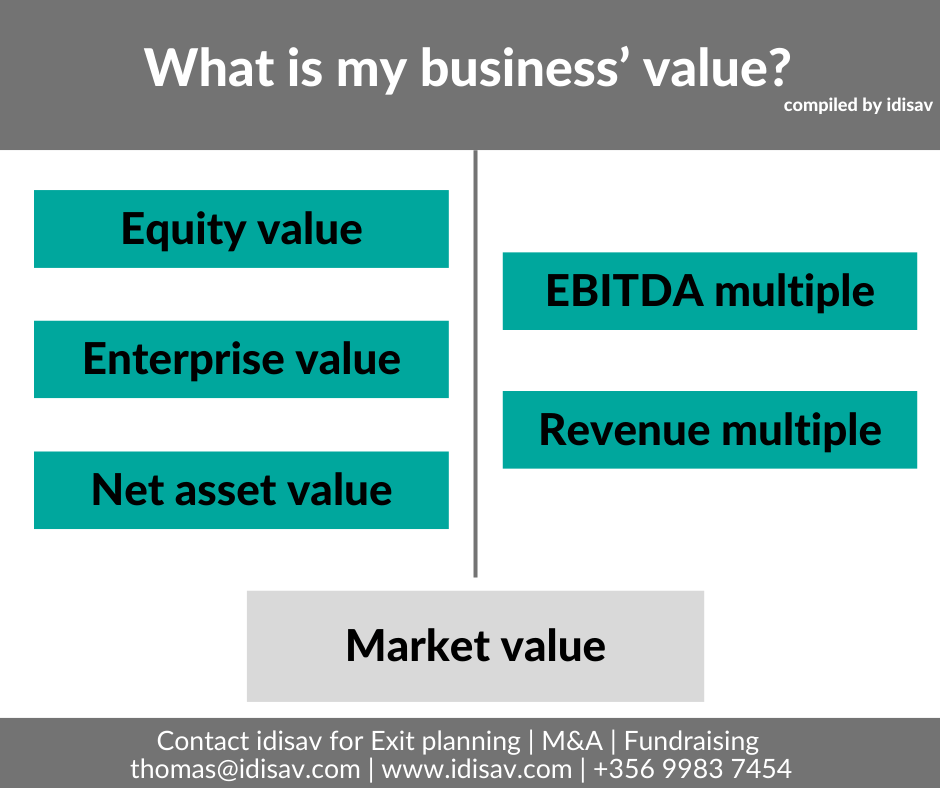

Business Valuations

When speaking with clients and prospects during their exit planning journey, the value of their business is often a key topic of discussion. A valuation exercise helps assess whether they have the financial freedom to move on from their business and embrace their next stage in life. It also sets a foundation for pricing expectationsContinue reading “Business Valuations”

Malta heads to further business consolidations!

Where are we? Business in Malta is heading for further consolidation in a number of industries, due to a host of factors that include family succession not being an option, industry specialisation, increased regulatory considerations, new market entrants, and changing cultural sentiments. Family succession not being an option As the business owners who founded theirContinue reading “Malta heads to further business consolidations!”

Am I ready to sell my company?

For many business owners, their company is more than just a source of income—it’s a part of their identity. But life is unpredictable, and circumstances can shift, prompting the need to consider an eventual exit. Whether it’s the lure of new opportunities, internal conflicts, or unexpected life events like divorce, disability, or distress, deciding toContinue reading “Am I ready to sell my company?”

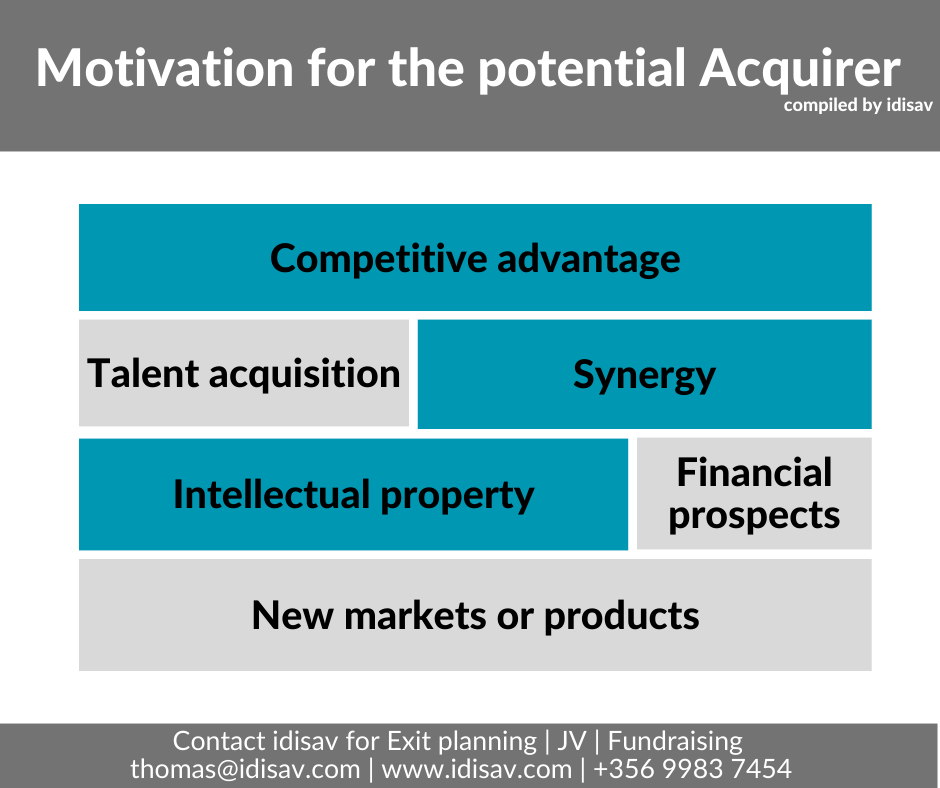

Motivation for a potential acquirer

A business owner needs to start understanding how a prospective acquirer will view their business. We’ll be delving into this topic on 3 July 2024 at 9am when I’ll be speaking at the KCPD Academy online event, “Exit Planning: Preparing for an Acquisition”. Sign-up here —> https://docs.google.com/forms/d/e/1FAIpQLSf1bQnkNVhrLVeuiRQ7CXox04AfxTUAddVZ9BPEWh9RoqnQQg/viewform-> Qualifies for 3 hours Core CPE (EUR35) 🧠

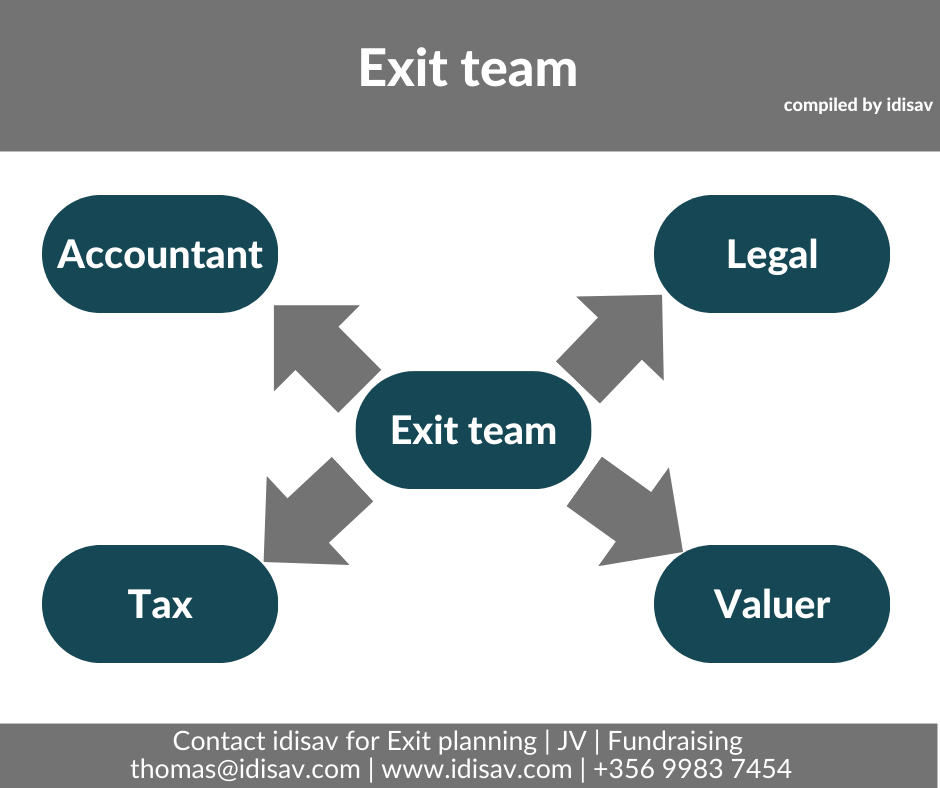

Exit team

Many people wonder why lawyers and accountants get so excited about mergers and acquisitions, well one of the main reasons is that it requires a lot of their billable time. Learn how to navigate the exit process on 3 July 2024 at 9am when I’ll be speaking at the KCPD Academy online event, “Exit Planning:Continue reading “Exit team”

Exit planning – Is it loss of identity?

As a business owner the first step in exit planning is often to ask yourself whether you want an exit and its impact on those around you. These are some of the topics I’ll be speaking about on 3 July 2024 at 9am together with KCPD Academy. Sign-up here —> https://docs.google.com/forms/d/e/1FAIpQLSf1bQnkNVhrLVeuiRQ7CXox04AfxTUAddVZ9BPEWh9RoqnQQg/viewform -> Qualifies for 3Continue reading “Exit planning – Is it loss of identity?”

When’s best to exit?

Extract from ‘Letting go is hard to do’: The results show that the mental difficulty of letting go is expected to be more severe if the anticipated exit time is in the more distant future. A plausible explanation is that the respondents planning exit in the near future have already addressed the issues of givingContinue reading “When’s best to exit?”

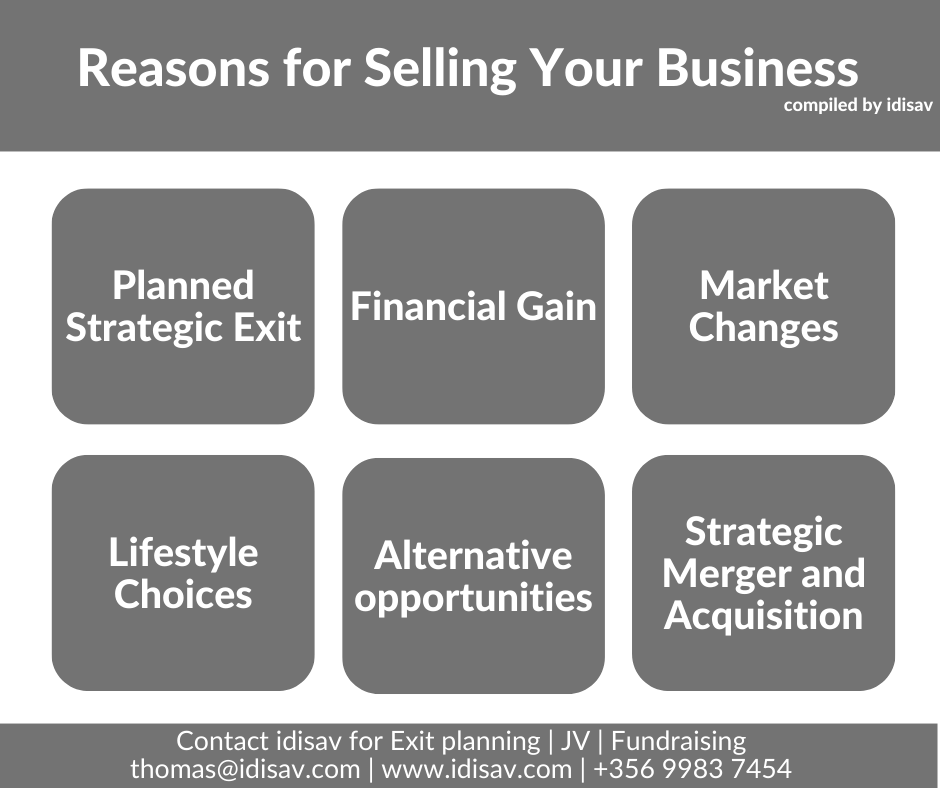

Reasons for Selling Your Business: Strategic Exit, Financial Gain, and More

Occasionally, when assisting business owners who are considering possibly exiting their company, they are faced with the typical misconception that a person selling their business is a sign of a failed business. In fact, this is a misinterpretation of what is a natural progression in a company’s journey. There are a host of reasons forContinue reading “Reasons for Selling Your Business: Strategic Exit, Financial Gain, and More”

Exploring the M&A landscape: Which is the most acquisitive accountancy firm?

Throughout the years, local accountancy practices have had to adapt to a host of challenges from increased specialisation and limited human resources to stringent regulatory requirements. This has led to a preference for firms to consider mergers or acquisitions for their established practices. The recent mergers and acquisitions in the accountancy sector have centred onContinue reading “Exploring the M&A landscape: Which is the most acquisitive accountancy firm?”