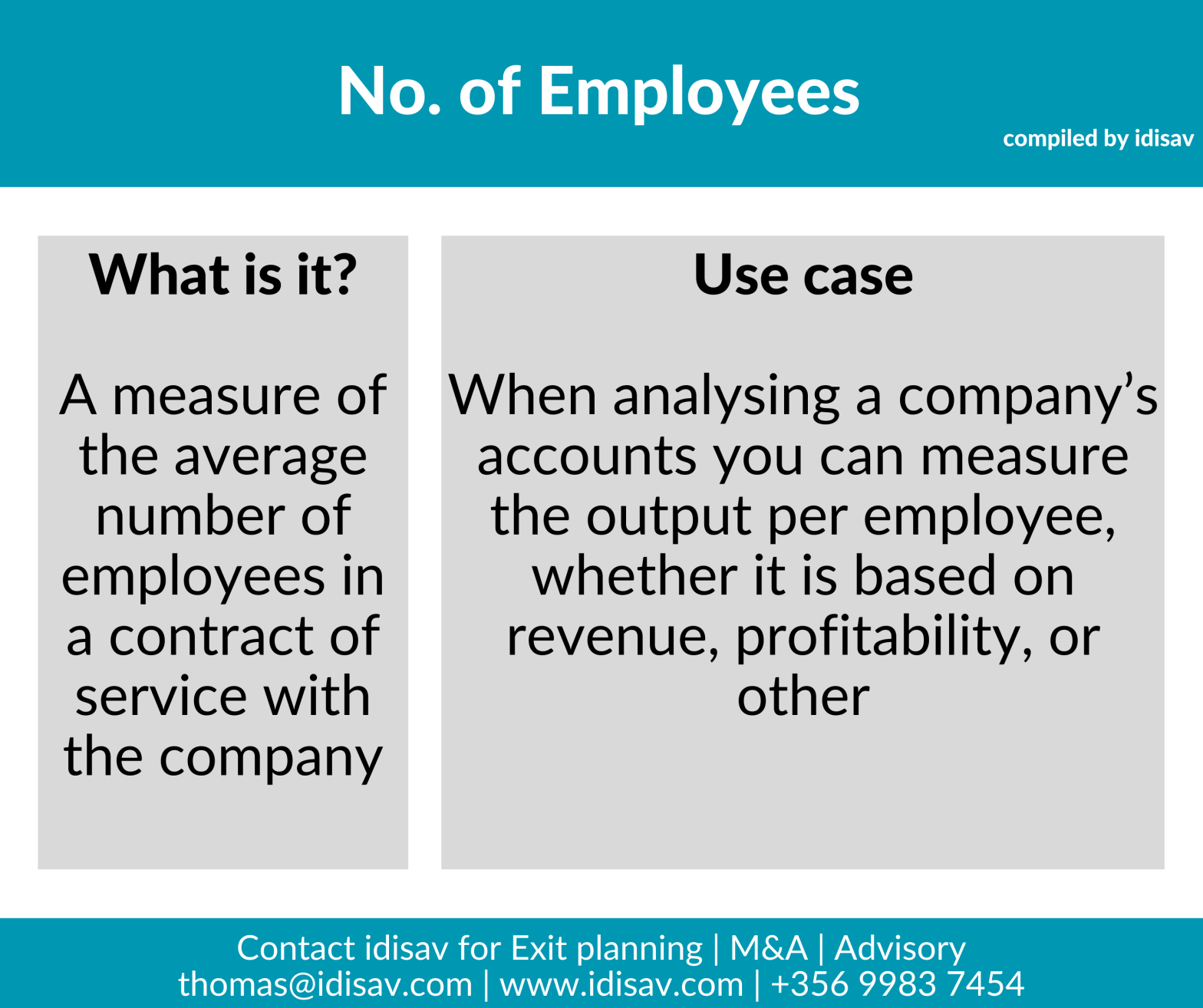

I’m often surprised by how many companies overlook employee productivity analysis. Start including it in your management accounts to drive better decisions and optimise growth. Employee KPIs, like revenue per employee and turnover rates, are key to measuring workforce efficiency and productivity. 👥📈

Tag Archives: malta

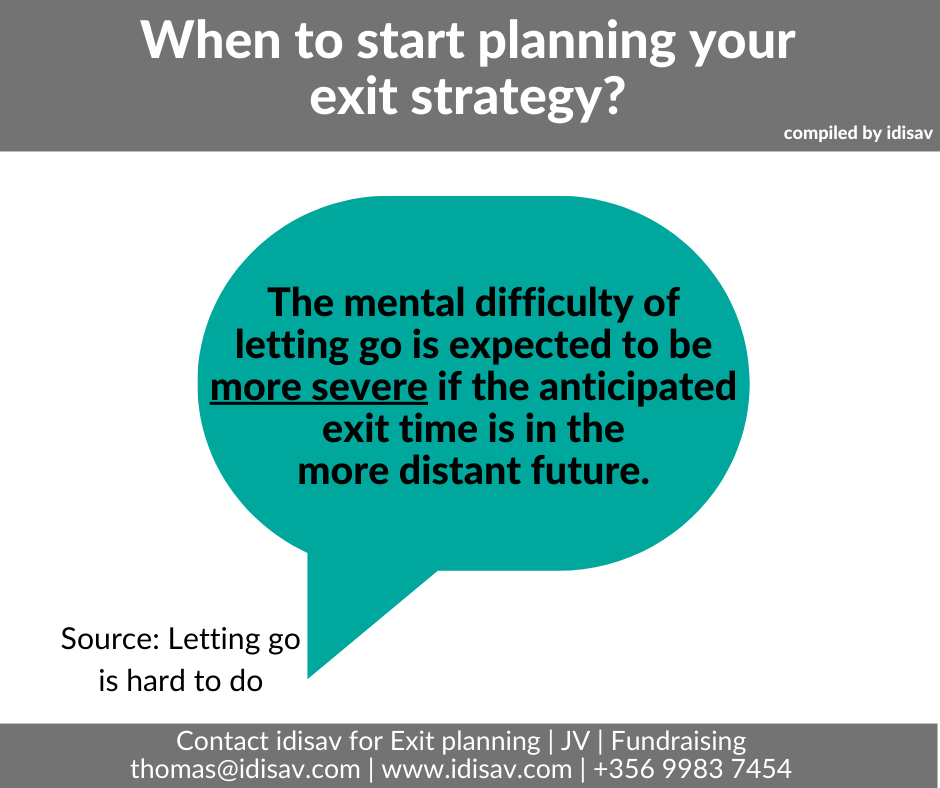

When’s best to exit?

Extract from ‘Letting go is hard to do’: The results show that the mental difficulty of letting go is expected to be more severe if the anticipated exit time is in the more distant future. A plausible explanation is that the respondents planning exit in the near future have already addressed the issues of givingContinue reading “When’s best to exit?”

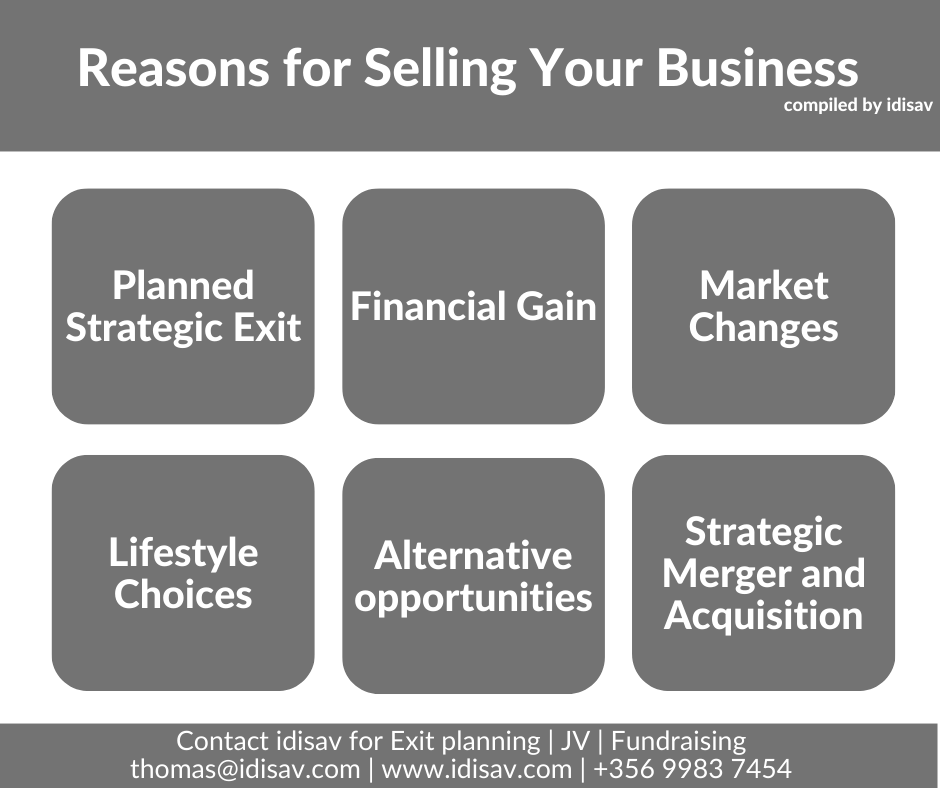

Reasons for Selling Your Business: Strategic Exit, Financial Gain, and More

Occasionally, when assisting business owners who are considering possibly exiting their company, they are faced with the typical misconception that a person selling their business is a sign of a failed business. In fact, this is a misinterpretation of what is a natural progression in a company’s journey. There are a host of reasons forContinue reading “Reasons for Selling Your Business: Strategic Exit, Financial Gain, and More”

A deep dive into accountancy firms’ Transparency Reports

The implementation of Transparency Reports instils stakeholders with increased confidence in the accounting profession on the basis of the accountants’ and auditors’ declarations. Such reports empower readers to make informed decisions, assured that their interests are safeguarded, and that auditors maintain independence, avoiding undue influence from any specific client’s financial significance. What is a transparencyContinue reading “A deep dive into accountancy firms’ Transparency Reports”

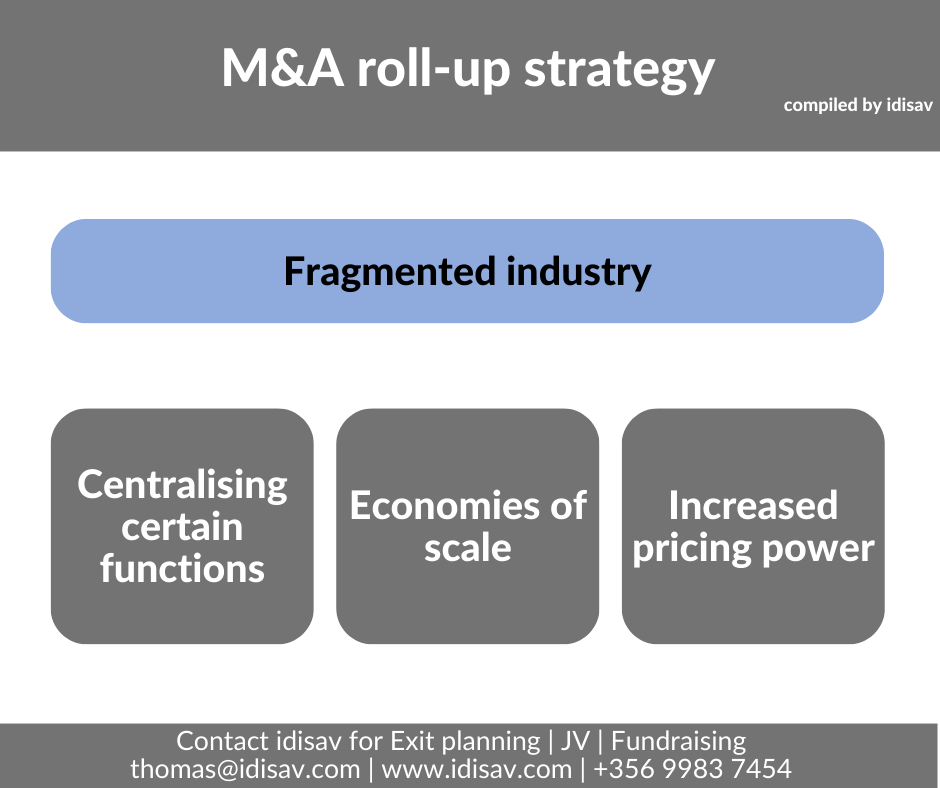

A Maltese M&A perspective on roll-up strategy

One of the recognised merger and acquisition frameworks is referred to as the ‘roll-up strategy’. Such a strategy is often prevalent in fragmented industries whereby a company expands its operations by acquiring smaller companies. Prominent Maltese examples that have adopted this strategy are evident in the pharmacy and grocery store sectors, where fragmented owner-operated enterprisesContinue reading “A Maltese M&A perspective on roll-up strategy”

Maximising your business’ potential with an exit strategy

🚀 Elevate Your Exit Strategy with idisav! 🌐 ✅ Make Long-Term Decisions ✅ Ensure a Smooth Transition ✅ Maximise Your Business Value ✅ Secure Recurring Income Post-Exit 📞 Contact idisav for personalized assistance. Let’s shape the future of your business! Check out this infographic – https://idisav.com/2023/05/30/exit-planning-position-the-company-to-achieve-its-greatest-value-%f0%9f%8f%86%f0%9f%92%aa%f0%9f%98%83/

Structuring a deal when business partners split

Business partnerships usually get off the ground with great enthusiasm and fanfare, but the separation of such a partnership can be a source of tension, fraught with difficulty, and time-consuming. This separation process may lead to a series of stop-start negotiations and other frustrations. In the scenario where the parties have already agreed on aContinue reading “Structuring a deal when business partners split”

Navigating Employee Buyouts: Challenges and Strategies

When I had considered selling my first business, I had quietly broached the idea with my key employees if they would consider taking on an ownership stake in the business. For one reason or another they had individually indicated to me that there was not a firm interest in taking on a shareholding and theContinue reading “Navigating Employee Buyouts: Challenges and Strategies”

Negotiation considerations when acquiring a business

In the process to acquire a business, one may need to negotiate and this may consist of: 💰 Price and Payment Terms 🤝 📦 Assets and Inventory 📊 ⚖️ Debts & Liabilities 💸 ⏳ Transition Period 🔄 🚫 Non-compete Agreement 👥 📝 Due Diligence and Contingencies 🕵️♂️ Contact thomas@idisav.com | +356 9983 7454 to assistContinue reading “Negotiation considerations when acquiring a business”

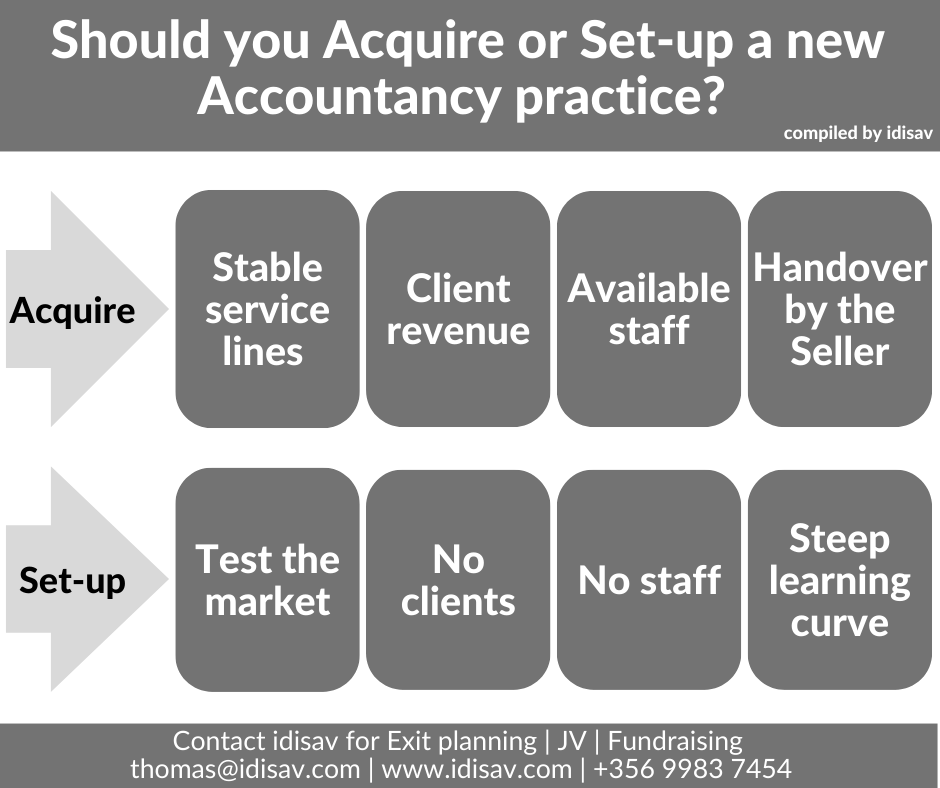

Should you Acquire or Set-up your Accountancy practice?

Why would you want to set-up your own Accountancy practice when you can Acquire one? Stable service lines Client revenue Available staff Handover by the seller Contact us on thomas@idisav.com or +356 9983 7454 to assist with your acquisition or exit strategy